Page 180 - CW E-Magazine (24-9-2024)

P. 180

Special Report

MANUFACTURER & EXPORTER

A GMP, ISO ( 9001:2015, 14001:2015 and 45001:2018), FSSAI, HALAL & KOSHER CERTIFIED COMPANY

AVAILABLE IN GRADE : IP/BP/USP/EP/FCC

• COPPER SULPHATE ANHYDROUS

• SODIUM DIHYDROGEN ORTHOPHOSPHATE DIHYDRATE

• DI-SODIUM HYDROGEN ORTHO PHOSPHATE ANHYDROUS

• DI-SODIUM HYDROGEN ORTHO PHOSPHATE DIHYDRATE

• TRI-SODIUM PHOSPHATE DODECAHYDRATE

Fig. 5: Price Trend. • POTASSIUM PHOSPHATE MONOBASIC

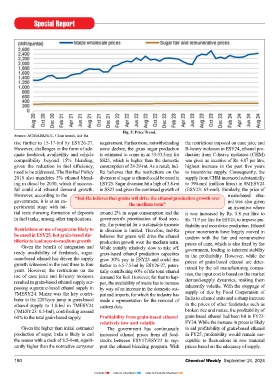

Source: AGMARKNET, Chini mandi, Ind-Ra

rise further to 15-17-bnl by ESY26-27. requirement. Furthermore, notwithstanding the restrictions imposed on cane juice and

However, challenges in the form of ade- some decline, the gross sugar production B-heavy molasses in ESY24, ethanol pro- • POTASSIUM PHOSPHATE DIBASIC

quate feedstock availability and vehicle is estimated to come in at 33-33.5-mt for duction from C-heavy molasses (CHM)

compatibility beyond 15% blending, SS25, which is higher than the domestic was given an incentive of Rs. 6.87 per litre, • SODIUM CARBONATE ANHYDROUS /MONO

given the reduction in fuel effi ciency, consumption of 28-29-mt. As a result, Ind- highest increase in the past fi ve years

need to be addressed. The Biofuel Policy Ra believes that the restrictions on the to incentivise supply. Consequently, the • MANGANESE SULPHATE

2018 also mandates 5% ethanol blend- diversion of sugar to ethanol could be eased in supply from CHM increased substantially

ing in diesel by 2030, which if success- ESY25. Sugar diversion hit a high of 3.8-mt to 390-mnl (million litres) in 8MESY24 • MANGANESE CHLORIDE

ful could aid ethanol demand growth. in SS23 and given the continued growth of (ESY23: 65-mnl). Similarly, the price of

However, according to the “Ind-Ra believes that grains will drive the ethanol production growth over maize-based etha- • MAGNESIUM SULPHATE ANHYDROUS

government, it is at an ex- nol was also given

perimental stage with ini- the medium term” an incentive where • POTASSIUM NITRATE

tial tests showing formation of deposits around 2% in sugar consumption and the it was increased by Rs. 5.8 per litre to

in fuel tanks, among other implications. government’s prioritisation of food secu- Rs. 71.9 per litre for ESY24, to improve pro- • POTASSIUM CHLORIDE

rity, the potential for a sustainable increase fi tability and incentivise production. Ethanol

Restrictions on use of sugarcane likely to in diversion is limited. Therefore, Ind-Ra price movements have largely moved in • POTASSIUM BROMIDE

be eased in ESY25, but grain-based dis- believes that grains will drive the ethanol tandem with the fair and remunerative

tilleries to lead near-to-medium growth production growth over the medium term. prices of cane, which is also fi xed by the

Given the benefi t of integration and While initially relatively slow to take off, IN BULK LR / AR GRADE CHEMICALS

ready availability of feedstock, sugar- grain-based ethanol production capacities government, leading to inherent stability

cane-based ethanol has driven the supply grew 30% yoy in ESY23 and could rise in the profi tability. However, while the

growth witnessed in the past three to four further to 6.5-7.5-bnl by ESY26-27, poten- prices of grain-based ethanol are deter- POTASSIUM DICHROMATE STARCH (POTATO) SOLUBLE

years. However, the restrictions on the tially contributing 60% of the total ethanol mined by the oil manufacturing compa- POTASSIUM CHROMATE BARIUM BROMIDE

use of cane juice and B-heavy molasses demand for fuel. However, for that to hap- nies, the input cost is based on the market SODIUM NITRATE ZINC BROMIDE

resulted in grain-based ethanol supply sur- pen, the availability of maize has to increase demand-supply dynamics, making them

passing sugarcane-based ethanol supply in by way of an increase in the domestic out- inherently volatile. With the stoppage of BISMUTH NITRATE /SUBNITRATE STRONTIUM BROMIDE

7MESY24. Maize was the key contri- put and imports, for which the industry has supply of rice by Food Corporation of CADMIUM NITRATE /SULPHATE CADMIUM BROMIDE /OXIDE

butor to the 220%yoy jump in grain-based made a representation for the removal of India to ethanol units and a sharp increase

ethanol supply to 1.8-bnl in 7MESY24 custom duty. in the prices of other feedstocks such as QUALIKEMS LIFESCIENCES PVT. LTD.

(7MESY23: 0.5-bnl), contributing around broken rice and maize, the profi tability of

60% to the total grain-based supply. Profi tability from grain-based ethanol grain-based ethanol had been hit in FY23- H.O & WORKS: Plot No.68-69, G.I.D.C Industrial Estate, Nandesari,

relatively low and volatile FY24. While the increase in prices is likely Vadodara - 391340 (GUJARAT).

Given the higher than initial estimated The government has continuously to aid profi tability of grain-based ethanol

production of sugar, India is likely to end increased ethanol prices from all feed- in FY25, profi tability would remain sus- Telefax : + 91-265-2841531,32,34,35 • Mobile: +91-92275 36999

the season with a stock of 8.5-9-mt, signifi - stocks between ESY17-ESY23 to sup- ceptible to fl uctuations in raw material Email: salesindia@qualikems.com & Info@qualikems.com

cantly higher than the normative carryover port the ethanol blending program. With prices based on the adequacy of supply. Web : www.qualikems.com

KNS ADI

180 Chemical Weekly September 24, 2024

Contents Index to Advertisers Index to Products Advertised