Page 178 - CW E-Magazine (24-9-2024)

P. 178

Special Report Special Report

Ethanol blending to continue to rise, despite restrictions

on sugar diversion; grains key to growth

ndia Ratings and Research (Ind-Ra) “While the target of 20% ethanol India Ratings and Research Pvt. Ltd.

believes India’s ethanol blending rate blending in petrol by 2026 still appears Email: Infogrp@indiaratings.co.in

Idemand will continue to increase in ambitious, given the feedstock availabi-

ESY24 (Ethanol Supply Year, Novem- lity and vehicle compatibility related chal- profi tability of cane-based ethanol is

ber-October), despite the restrictions on lenges, the ethanol segment could witness likely to remain more stable than that

the use of sugarcane-based ethanol. The double-digit growth even with a blend- of grain, which remains susceptible to

reduction in supplies due to the restriction ing rate of 16%-17%. The over 200% volatility in input prices,” says Khushbu

on diversion of sugar towards ethanol is increase in the blending rate between Lakhotia, Director, Ind-Ra.

likely to be offset by a jump in supply ESY20-23 was largely driven by sugar-

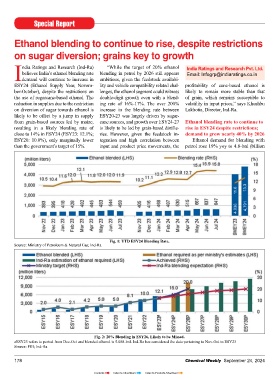

from grain-based sources led by maize, cane sources, and growth over ESY24-27 Ethanol blending rate to continue to Fig. 3: Ethanol Supplied by Grain and Sugar By-products for Blending.

resulting in a likely blending rate of is likely to be led by grain-based distille- rise in ESY24 despite restrictions; Source: PIB; Ind-Ra

close to 14% in ESY24 (ESY23: 12.1%; ries. However, given the feedstock in- demand to grow nearly 40% by 2026

ESY20: 10.0%), only marginally lower tegration and high correlation between Ethanol demand for blending with

than the government’s target of 15%. input and product price movements, the petrol rose 19% yoy to 4.8-bnl (billion

11.6 13.3

4,036 4,791

Fig. 4: Continued Increase in Ethanol Prices Encouraging; Reasonable Linkage with Cane FRP.

Source: PIB; Ind-Ra

litres) in 9MESY24, indicating a blend- creasing supply and thereby reducing ambitious target to reach 20% ethanol

ing ratio of 13.3% (9MESY23: 11.6%). sugar prices. This led to a sharp fall in the blending, requiring around 10-bnl of

Fig. 1: YTD ESY24 Blending Rate.

Source: Ministry of Petroleum & Natural Gas; Ind-Ra While the current blending ratio is lower sugarcane-based ethanol production to ethanol by 2026, Ind-Ra believes that

than the government’s targeted rate of 1.75-bnl in 7MESY24 (7MESY23: 2.5-bnl), even a lower blending rate of 16%-17%

15%, the blending rate has been above reducing its contribution to around would translate into a double-digit

15% since May 2024 with an increase 50% (82%) of the country’s ethanol sup- annual growth rate to hit around 8-bnl by

in production of ethanol through grains. plied for fuel. While the sugarcane pro- 2026. From a modest 5% in ESY20,

duction is lower at around 443.5-mt for the blending rate had reached 12% in

Ind-Ra believes that India “Ind-Ra believes that India is likely to achieve a blending rate of ESY23, in line

is likely to achieve a blending around 14% in ESY24, marginally short of the 15% target, despite the with the targets

rate of around 14% in ESY24, restrictions on the use sugarcane-based ethanol.” leading to the

marginally short of the 15% ethanol demand

target, despite the restrictions on the use SS24 (SS23: 490.5-mt), the cane crush- for blending rising to around 5.5-bnl

sugarcane-based ethanol. Based on the ing season is already over, and Ind-Ra (ESY20: 1.7-bnl). With the govern-

initial expectations of a fall in the gross believes its share is likely to fall below ment’s focus and incentivisation in the

sugar production to around 33.5-mt in 50% in ESY24 for the fi rst time. form of interest subventions on loans,

sugar season 2024 (SS23: 37.2-mt), the annual price hikes, etc., the segment

government restricted the diversion of 20% blending by 2026 ambitious, but has seen signifi cant capacities additions.

Fig. 2: 20% Blending in ESY26, Likely to be Missed.

aESY23 refers to period from Dec-Oct and blended ethanol is 5.088-bnl. Ind-Ra has considered the data pertaining to Nov-Oct in ESY23 sugar towards ethanol to 1.7-mt (SS23: double-digit growth likely Capacities rose to around 12.5-bnl by

Source: PIB; Ind-Ra 3.8-mt) for ESY24 with the aim of in- While the government has set an ESY23, up 80% over ESY20, and could

178 Chemical Weekly September 24, 2024 Chemical Weekly September 24, 2024 179

Contents Index to Advertisers Index to Products Advertised