Page 180 - CW E-Magazine (30-1-2024)

P. 180

Special Report

could average about +10% or –3%

around the current level of $77 in

2024, but it could swing wildly above

it should there be any disruption

in supplies. Attacks on oil tankers

by the Houthis cannot be ruled out;

besides there is a big appetite for $85+

amongst the oPEC. A production cut

here and bombing there would be

sufficient trigger a hike.

Investment flows

Global investment flows are not

just important for the recipient nation

to grow, but is also a proxy health

indicator (relative attractiveness of an

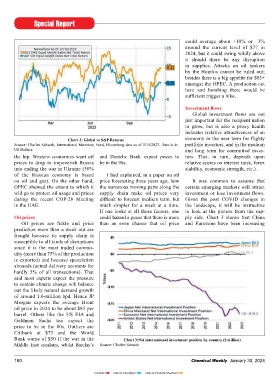

Chart 2: Global vs S&P Returns economy in the near term for flighty

Source: Charles Schwab, International Monetary Fund, Bloomberg data as of 11/5/2023. Data is in portfolio investors, and in the medium

US Dollars. and long term for committed inves-

the hip. Western economies want oil and Deutche Bank expect prices to tors. This, in turn, depends upon

prices to drop to impoverish Russia be in the 90s. relative scores on interest rates, forex

into ending the war in Ukraine (50% stability, economic strength, etc.).

of the Russian economy is based I had explained, in a paper on oil

on oil and gas). on the other hand, price forecasting three years ago, how It was common to assume that

oPEC showed the extent to which it the numerous moving parts along the certain emerging markets will attract

will go to protect oil usage and prices supply chain make oil prices very investment or lose investment flows.

during the recent CoP-28 Meeting difficult to forecast medium term, but Given the post CovID changes in

in the UAE. much simpler for a week at a time. the landscape, it will be instructive

If one looks at all those factors, one to look at the picture from the sup-

Oil prices could hazard a guess that there is more ply side. Chart 3 shows that China

Oil prices are fickle and price than an even chance that oil price and Eurozone have been increasing

prediction more than a week out are

fraught because its supply chain is

susceptible to all kinds of disruptions

since it is the most traded commo-

dity (more than 75% of the production

is exported) and because speculation

abounds (actual delivery accounts for

hardly 5% of all transactions). That

said most experts expect the pressure

to contain climate change will balance

out the likely natural demand growth

of around 1.6-million bpd. Hence JP

Morgan expects the average Brent

oil price in 2024 to be about $83 per

barrel. others like the US EIA and

Goldman Sachs too expect the

price to be in the 80s. outliers are

Citibank at $73 and the World

Bank warns of $50 if the war in the Chart 3:Net international investment position by country ($ trillion)

Middle East escalates, whilst Barclay’s Source: Charles Schwab

180 Chemical Weekly January 30, 2024

Contents Index to Advertisers Index to Products Advertised