Page 179 - CW E-Magazine (30-1-2024)

P. 179

Special Report

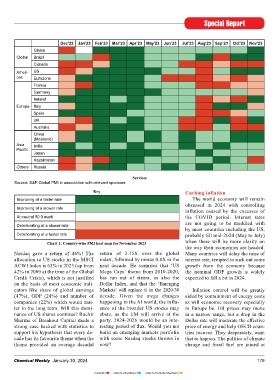

Dec’22 Jan’23 Feb’23 Mar’23 Apr’23 May’23 Jun’23 Jul’23 Aug’23 Sep’23 Oct’23 Nov’23

Global

Global Brazil

Canada

Ameri- US

cas Eurozone

France

Germany

Ireland

Europe Italy

Spain

UK

Australia

China

(Mainland)

Asia India

Pacific

Japan

Kazakhstan

Others Russia

Services

Source: S&P Global PMI in association with relevant sponsors

Key Curbing inflation

Improving at a faster rate The world economy will remain

obsessed in 2024 with controlling

Improving at a slower rate

inflation caused by the excesses of

At neutral 50.0 mark the CovID period. Interest rates

are not going to be meddled with

Deteriorating at a slower rate

by most countries including the US,

Deteriorating at a faster rate probably till mid-2024 (May to July)

Chart 1: Country-wise PMI heat map for November 2023 when there will be more clarity on

the way their economies are headed.

Nasdaq gave a return of 46%! The return of 2.75X over the global Many countries will delay the raise of

allocation to US stocks in the MSCI index, followed by minus 0.8X in the interest rate, tempted to suck out some

ACWI Index is 62% in 2023 (up from next decade. He surmises that ‘US growth from the economy because

42% in 2009 at the time of the Global Mega Caps’ theme from 2010-2020, the nominal GDP growth is widely

Credit Crisis), which is not justified has run out of steam, as also the expected to fall a bit in 2024.

on the basis of most economic indi- Dollar Index, and that the ‘Emerging

cators like share of global earnings Markets’ will replace it in the 2020-30 Inflation control will be greatly

(47%), GDP (24%) and number of decade. Given the mega changes aided by containment of energy costs

companies (22%) which would mat- happening in the AI world, the influ- as will economic recovery especially

ter in the long term. Will this domi- ence of the broader US stocks may in Europe be. oil prices may move

nance of US shares continue? Ruchir abate, as the EM will arrive at the in a narrow range, but a drop in the

Sharma of Breakout Capital made a party. 2024-2026 would be an inte- Dollar rate will moderate the effective

strong case backed with statistics to resting period of flux. Would you not price of energy and help oECD coun-

support his hypothesis that every de- build an emerging markets portfolio tries recover. They desperately, want

cade has its favourite theme when the with some Nasdaq stocks thrown in that to happen. The politics of climate

theme provided an average decadal now? change and fossil fuel are joined at

Chemical Weekly January 30, 2024 179

Contents Index to Advertisers Index to Products Advertised