Page 178 - CW E-Magazine (30-1-2024)

P. 178

Special Report

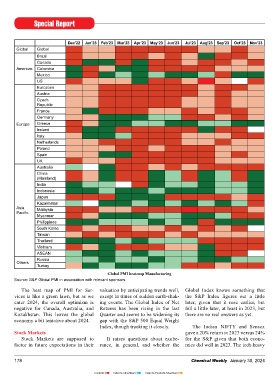

Dec’22 Jan’23 Feb’23 Mar’23 Apr’23 May’23 Jun’23 Jul’23 Aug’23 Sep’23 Oct’23 Nov’23

Global Global

Brazil

Canada

Americas Colombia

Mexico

US

Eurozone

Austria

Czech

Republic

France

Germany

Europe Greece

Ireland

Italy

Netherlands

Poland

Spain

UK

Australia

China

(Mainland)

India

Indonesia

Japan

Kazakhstan

Asia Malaysia

Pacific

Myanmar

Philippines

South Korea

Taiwan

Thailand

Vietnam

ASEAN

Russia

Others

Turkey

Global PMI heatmap Manufacturing

Source: S&P Global PMI in association with relevant sponsors.

The heat map of PMi for Ser- valuation by anticipating trends well, Global index knows something that

vices is like a green lawn, but as we except in times of sudden earth-shak- the S&P Index figures out a little

enter 2024, the overall optimism is ing events. The Global index of Net later, given that it rose earlier, but

negative for Canada, Australia, and Returns has been rising in the last fell a little later, at least in 2023, but

Kazakhstan. This leaves the global Quarter and seems to be widening its there are no real answers as yet.

economy a bit tentative about 2024. gap with the S&P 500 Equal Weight

index, though tracking it closely. The indian NiFTY and Sensex

Stock Markets gave a 20% return in 2023 versus 24%

Stock Markets are supposed to it raises questions about exube- for the S&P given that both econo-

factor in future expectations in their rance, in general, and whether the mies did well in 2023. The tech-heavy

178 Chemical Weekly January 30, 2024

Contents Index to Advertisers Index to Products Advertised