Page 176 - CW E-Magazine (3-9-2024)

P. 176

Special Report Special Report

BUSINESS OUTLOOK oversupply and the subdued global

Caustic soda industry to see slight recovery (%) Grasim GACL fundamentals to be a key concern

over the near term and could impact

TGV SRAAC DCM Sriram the recovery in domestic prices.

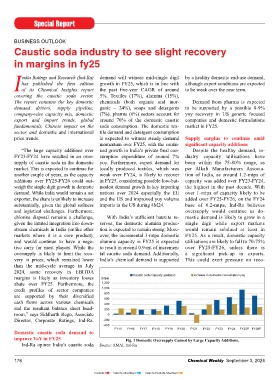

in margins in fy25 Epifral Andhra Sugar After averaging around $420 per

DCW Nirma tonne over FY16-FY20, international

ndia Ratings and Research (Ind-Ra) demand will witness mid-single digit by a healthy domestic end-use demand, Durgapur Kutch Chemical prices jumped to $665 per tonne by

has published the fi rst edition growth in FY25, which is in line with although export conditions are expected Gujarat Fluoro Reliance FY23 owing to supply chain con-

Iof its Chemical Insights report the past fi ve-year CAGR of around to be weak over the near term. Chemplast Primo strains amid the post-covid recovery

covering the caustic soda sector. 5%. Textiles (17%), alumina (15%), Chemfab Alkalis Bodal Chemicals in demand. Prices corrected sharply

The report contains the key domestic chemicals (both organic and inor- Demand from pharma is expected Mundra Others to $425 per tonne in FY24, close to

demand drivers, supply pipeline, ganic – 24%), soaps and detergents to be supported by a possible 8-9% Inner Circle is FY21; Followed by FY24 & FY26 the mid-cycle average, post which

company-wise capacity mix, domestic (7%), pharma (6%) sectors account for yoy recovery in US generic focused Fig. 2 Change in Capacity share over FY21-FY26. some improvement is seen in FY25

export and import trends, global around 70% of the domestic caustic companies and domestic formulations Source: Company, Ind-Ra (July 2024: $495 per tonne).

fundamentals, Chinese impact on the soda consumption. The domestic tex- market in FY25.

sector, and domestic and international tile demand and detergent consumption SE Asia caustic soda CFR price While domestic price also wit-

price trends. is expected to witness steady demand Supply surplus to continue amid (USD/t) NNS caustic soda fl ake prices – India (domestic price) nessed a sharp jump in FY23 fol-

momentum over FY25, with the contin- signifi cant capacity additions 1,200 lowed by a correction in FY24, it re-

“The large capacity additions over ued growth in India’s private fi nal con- Despite the healthy demand, in- 1,000 mained below the mid-cycle average

FY23-FY24 have resulted in an over- sumption expenditure of around 7% dustry capacity utilisations have 800 of around $625 per tonne given the

supply of caustic soda in the domestic yoy. Furthermore, export demand for been within the 75-80% range, as 600 oversupply conditions (FY24: $510

market. This is expected to continue for locally produced textiles, which was per Alkali Manufacturers Associa- 400 per tonne, July 2024: $520 per tonne)

another couple of years, as the capacity weak over FY24, is likely to recover tion of India, as around 1.2-mtpa of 200 with limited upside likely in FY25.

additions over FY25-FY26 could out- in FY25, considering possible low-but- capacity was added over FY23-FY24, 0

weigh the single digit growth in domestic modest demand growth in key importing the highest in the past decade. With March15 Jul 15 Nov 15 Mar 16 Jun 16 Oct 16 Feb 17 May 17 Sep 17 Jan 18 May 18 Aug 18 Dec 18 Apr 19 Jul 19 Nov 19 Mar 20 Jul 20 Oct 20 Feb 21 Jun 21 Sep 21 Jan 22 May 22 Sep 22 Dec 22 Apr 23 Aug 23 Nov 23 Mar 24 Jul 24 The fall in prices resulted in a

demand. While India would remain a net nations over 2024 especially the EU over 1-mtpa of capacity likely to be revenue decline of 30-35% yoy in

exporter, the share is unlikely to increase and the US and improved yoy volume added over FY25-FY26, on the FY24 Fig. 3 Price Recovery to be Gradual. FY24 at a sectoral level and impacted

substantially, given the global softness imports in the US during 4M24. base of 6.2-mtpa, Ind-Ra believes Source: Bloomberg, Ind-Ra the spreads, while production costs

and logistical challenges. Furthermore, oversupply would continue as do- very in domestic caustic soda prices. FY21-FY24 (FY15-FY20: 3%-5%) while sustained at similar levels. The lower

chlorine disposal remains a challenge, With India’s suffi cient bauxite re- mestic demand is likely to grow in a India’s domestic consumption growth India’s imports as a proportion of con- product spreads coupled with inven-

given the limited integration into down- serves, the domestic alumina produc- single digit while export markets has lagged capacity addition over the sumption had reduced to around 5% tory losses, given the nearly secular fall

stream chemicals in India (unlike other tion is expected to remain strong. More- would remain subdued at least in past 7-8 years, coming in at 4% com- over the same period (around 11%). in prices, resulted in EBITDA margins

markets where it is a core product), over, the incremental 3-mtpa domestic FY25. As a result, domestic capacity pared to the average domestic capacity contracting to around 10% in FY24

and would continue to have a nega- alumina capacity in FY25 is expected utilisations are likely to fall to 70-75% growth of 8.2% p.a., resulting in India Slight recovery in margins as inventory (FY23: 25%) with some companies

tive carry for most players. While the to result in around 0.9-mt of incremen- over FY25-FY26, unless there is becoming net exporters since FY21. losses abate, but price recovery to be reporting losses in 2QFY24-3QFY24.

oversupply is likely to limit the reco- tal caustic soda demand. Additionally, a signifi cant pick-up in exports. India’s exports as a proportion of pro- gradual Over the past 25 quarters, sector partici-

very in prices, which remained lower India’s chemical demand is supported This could exert pressure on reco- duction had increased to 8-10% over Ind-Ra expects the domestic pants have recorded average quarterly

than the mid-cycle average in July EBITDA margins of around 21%. Ind-Ra

2024, some recovery in EBITDA Revenue growth EBITDA margin believes the oversupply situation may

margins is likely as inventory losses (ktpa) Caustic soda capacity additions increase in domestic consumption yoy (%) limit correction in prices, although

abate over FY25. Furthermore, the 1,200 50 greater stability is expected in FY25

credit profi les of sector companies 1,000 40 which could lead to some improve-

30

are supported by their diversifi ed 800 20 ment in the margins as inventory

600

10

cash fl ows across various chemicals 400 0 losses abate.

and the resultant balance sheet head- 200 -10

-20

room,” says Siddharth Rego, Associate 0 -30 India to remain net exporter;

Director, Corporate Ratings, Ind-Ra. -200 -40 growth contingent upon absorption

-400 of export volumes

FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25P FY26P 1QFY18 2QFY18 3QFY18 4QFY18 1QFY19 2QFY19 3QFY19 4QFY19 1QFY20 2QFY20 3QFY20 4QFY20 1QFY21 2QFY21 3QFY21 4QFY21 1QFY22 2QFY22 3QFY22 4QFY22 1QFY23 2QFY23 3QFY23 4QFY23 1QFY24 2QFY24 3QFY24 4QFY24 1QFY25

Domestic caustic soda demand to Net exports grew 3x-3.5x yoy in

improve YoY in FY25 Fig. 1 Domestic Oversupply Caused by Large Capacity Additions. Fig. 4 Slight Recovery in Margins as Inventory Losses Abate. 2MFY25 amid the domestic surplus

Ind-Ra opines India’s caustic soda Source: AMAI, Ind-Ra Source: Company annual reports & presentation Ind-Ra volumes. However, the ability of export

176 Chemical Weekly September 3, 2024 Chemical Weekly September 3, 2024 177

Contents Index to Advertisers Index to Products Advertised