Page 163 - CW E-Magazine (10-6-2025)

P. 163

Special Report

There’s a lesson from solar: adop-

tion accelerates when users see

economic sense. Green hydrogen in Bharat Jyoti Impex

chemicals can play that role – paving

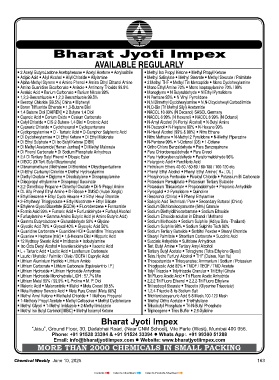

the way for wider uptake across sectors. AVAILABLE REGULARLY

2 Acetyl ButyroLactone Acetophenone Acetyl Acetone Acrylonitrile Methyl Iso Propyl Ketone Methyl Propyl Ketone

The Experience Curve: Falling costs Adipic Acid Allyl Alcohol Allyl Chloride Allylamine Methyl Salicylate Methyl Stearate Methyl Stearate / Palmitate

and future bets Alpha-Methyl Styrene 4 Amino Phenol Amino Ethyl Ethanol Amine 2 Methyl THF Methyl Tin Mercaptide Mono Cyclohexylamine

If solar is any guide, green hydro- Amino Guanidine Bicarbonate Anisole Antimony Trioxide 99.8% Mono Ethyl Amine 70% Mono Isopropylamine 70% / 99%

Azelaic Acid Barium Carbonate Barium Nitrate 99%

Monoglyme N Butyraldehyde N Ethyl Pyrrolidone

gen costs will drop sharply. Electro- 1,2,3-Benzotriazole 1,2,3 Benzotriazole 99.5% N Pentane 95% N Vinyl Pyrrolidone

lyser prices are already falling, and scale Benzoyl Chloride [99.5%] China Biphenyl N,N Dimethyl Cyclohexylamine N,N-Dicyclohexyl Carbodiimide

will accelerate this trend. For chemical Boron Trifluoride Etherate 1,3-Butane Diol N,O-Bis (Tri Methyl Silyl) Acetamide

plant expansions, the key question is: 1,4 Butane Diol [DAIREN] 2 Butyne 1,4 Diol NACOL 10-99% (N Decanol) SASOL Germany

against the lowest-cost grey hydrogen reduce confusion and risk – though Will today’s grey hydrogen asset look Caproic Acid Cerium Oxide Cesium Carbonate NACOL 6 99% (N Hexanol) NACOL 8 99% (N Octanol)

N-Amyl Alcohol (N-Pentyl Alcohol) N-Butyl Amine

Cetyl Chloride CIS-2-Butene-1,4-Diol Crotonic Acid

benchmark. Targeting high-cost users such regulatory overlaps are not like a liability in 5-10 years? Taking a Cyanuric Chloride Cyclohexanol Cyclopentanone N-Decanol N-Heptane 99% N-Hexane 99%

gives green H the fairest chance to unique to green hydrogen. calculated bet on green hydrogen now Cyclopropylamine D - Tartaric Acid D-Camphor Sulphonic Acid N-Hexyl Alcohol (99% & 98%) Nitro Ethane

2

prove itself. may future-proof investments. Di Cyclohexylamine Di Ethyl Ketone Di Ethyl Malonate Nitro Methane N-Methyl 2 Pyrolidone N-Methyl Piperazine

The consensus: if we want real Di Ethyl Sulphate Di Iso Butyl Ketone [DIBK] N-Pentane 99% 1-Octanol (C8) 1-Octene

Ortho Chloro Benzaldehyde Para Benzoquinone

Di Methyl Acetamide [Henan Junhua] Di Methyl Malonate

Enabling policy: Incentives that deployment, low-cost, low-barrier pilot Policies like the European Union’s Di Phenyl Carbonate Di Sodium Phosphate Anhydrous Para Chlorobenzaldehyde Para Cresol

could unlock deployment support is the quickest way to unlock Carbon Border Adjustment Mechanism 2,4 Di Tertiary Butyl Phenol Dibasic Ester Para Hydroxybenzaldehyde Paraformaldehyde 96%

Many chemical-sector hydrogen momentum. (CBAM) or domestic carbon pric- DIBOC (Di Tert. Butyl Dicarbonate) Pelargonic Acid Perchloric Acid

users are unaware of existing subsidies, ing could further shift the economics. Dibromomethane (Methylene Di Bromide) Dicyclopentadiene Petroleum Ethers 40-60 / 60-80 / 80-100 / 100-120 etc.

Di-Ethyl Carbamyl Chloride Diethyl Hydroxylamine

Phenyl Ethyl Alcohol Phenyl Ethyl Amine [ R+ ; DL ]

as early green hydrogen efforts focused Why chemicals should matter to While these factors carry uncertainty, Diethyl Oxalate Diglyme Diisobutylene Diisopropylamine Phosphorous Pentoxide Pivaloyl Chloride Potassium Bi Carbonate

on steel and refi ning. There’s much to National Hydrogen Policy the trend line points in one direction – Diisopropyl ethylamine Diisopropyl Succinate Potassium Persulphate Potassium Tertiary Butoxide

learn from those sectors – but policy- For policymakers, green hydrogen towards green hydrogen becoming 2,2-Dimethoxy Propane Dimethyl Oxalate Di-N-Propyl Amine Potassium Thioacetate Propionaldehyde Propionic Anhydride

makers must hear directly from chemi- adoption in the chemical sector offers a the safer long-term choice. DL Alfa Phenyl Ethyl Amine D-Ribose DMSO (Hubei Xingfa) Pyrogallol 2-Pyrrolidone Quinoline

cal industry stakeholders. Pilot projects rare opportunity: projects that are close Ethyl Benzene Ethyl Cyclo Hexane 2 Ethyl Hexyl Bromide Resorcinol (China) R Phenyl Ethylamine

2-Ethylhexyl Thioglycolate Ethyl Nicotinate Ethyl Silicate

Salicylic Acid Technical / Pure Secondary Butanol (China)

and techno-economic studies can help to commercial viability even without Turning discussion into deployment: Ethylene Glycol Diacetate (EGDA) Fluorobenzene Formamide Sodium Dichloroisocyanurate (56%) Granule

make the case. subsidies. In contrast, steel, ammonia, The way forward Formic Acid 99% Fumaric Acid Furfuraldehyde Furfuryl Alcohol Sodium Diethyldithiocarbamate Sodium Ethoxide

and refi ning remain far from cost-parity. This roundtable was a fi rst step to- Furfurylamine Gamma Amino Butyric Acid (4 Amino Butyric Acid) Sodium Ethoxide solution in Ethanol / Methanol

Green hydrogen producers also With modest support, chemical pro- ward putting the chemical sector on the Gamma Butyrolactone Glutaraldehyde 50% Glycine Sodium Methoxide Sodium Sulphite (Aditya Birla -Thailand)

have a stake: a vibrant chemical-sector jects can become the fi rst truly bankable green hydrogen map. To translate ideas Glycolic Acid 70% Glyoxal 40% Glyoxylic Acid 50% Sodium Sulphite 98% Sodium Sulphite Tech 90%

Sodium Tertiary Butoxide Sorbitol Powder Stearyl Bromide

Guanidine Carbonate Guanidine HCl Guanidine Thiocyanate

market could trigger dozens of 1-50 MW examples of green hydrogen use. into impact, we now need sustained Guanine Heptane [mix] 1,6-Hexane Diol Hippuric Acid Stearyl Palmitate Strontium Carbonate Succinic Acid

projects, helping absorb electrolyser follow-up – not just policy engage- 12 Hydroxy Stearic Acid Imidazole Isobutylamine Succinic Anhydride Sulfolane Anhydrous

capacity and stabilize demand – Furthermore, green hydrogen pro- ment, but also on-the-ground deploy- Iso Octa Decyl Alcohol Isovaleraldehyde Itaconic Acid Tert. Butyl Amine Tertiary Amyl Alcohol

especially as uptake in other sectors lags. jects generate national-level positive ment through pilot projects and hydro- L + Tartaric Acid Lactic Acid Lanthanum Carbonate Tertiary Butyl Acetate Tetraglyme (Tetra Ethylene Glycol)

Tetra Hydro Furfuryl Alcohol THF (Dairen, Nan Ya)

Lauric / Myristic / Palmitic / Oleic / DCFA / Caprylic Acid

externalities: localized, distributed genclusters. This calls for coordination Lithium Aluminium Hydride Lithium Amide Thioacetamide Thiocyanates: Ammonium / Sodium / Potassium

The roundtable fl agged several policy production reduces the need for long- across industry, government, and tech- Lithium Carbonate Lithium Carbonate [Equivalent to I.P.] Thioglycolic Acid 80% TMOF / TEOF / TMO Acetate

levers with immediate impact: distance road transport of hazardous nology providers. Lithium Hydroxide Lithium Hydroxide Anhydrous Tolyl Triazole Tolyltriazole Granular Tri Ethyl Citrate

Waiving wheeling and transmission high-pressure hydrogen gas and large Lithium Hydroxide Monohydrate LIOH : 57.7% Min Tri Fluoro Acetic Acid Tri Fluoro Acetic Anhydride

2,2,2 Tri Fluoro Ethanol 2,2,2-Tri Fluoro Ethylene

Lithium Metal 99% / 99.9% L-Proline M. P. Diol

charges for pilot projects (<30 MW) hydrogen storage inventories, thereby The path will take time and effort – Malonic Acid Malononitrile Maltol Meta Cresol 99.5% Tri Isodecyl Stearate Triacetin (Glycerine Triacetate)

could signifi cantly reduce LCOH, as enhancing chemical-site safety. but the discussions leave us cautiously Meta Hydroxy Benzoic Acid Meta Para Cresol [Meta 60%] 1,2,4-Triazole & its Sodium Salt

renewable electricity costs Rs. 4/kWh optimistic that the chemical sector can Methyl Amyl Ketone Methallyl Chloride 1 Methoxy Propanol Trichloroisocyanuric Acid 5-8 Mesh,100-120 Mesh

but surcharges add substantially. The scale also fi ts perfectly. Pro- lead with scalable, commercially viable 1-Methoxy Propyl Acetate Methyl Cellosolve Methyl Cyclohexane Triethyl Ortho Acetate Triethylsilane

Methyl Glycol 1-Methyl Imidazole 2-Methyl Imidazole

Triisobutyl Phosphate Tri-N-Butyl Phosphate

Lowering subsidy thresholds (cur- jects in the 10-50 MW range can act as models. Methyl Iso Butyl Carbinol [MIBC] Methyl Isoamyl Ketone Triphosgene Triss Buffer 2,6-Xylidine

rently at 50 MW) would enable bridging pilots between today’s 10-MW

smaller, scalable pilots. operations and the gigawatt-scale ambi- With the right pilots and modest Bharat Jyoti Impex

State-level incentives can be deci- tions of the National Green Hydrogen support, green hydrogen in chemicals “Jasu”, Ground Floor, 30, Dadabhai Road, (Near CNM School), Vile Parle (West), Mumbai 400 056.

sive, yet vary widely across India. Mission (NGHM). Investors and minis- can scale fast – and show the rest of the Phone: +91 91528 33394 & +91 91524 33394 Whats App:. +91 99300 51288

Streamlining regulations (e.g., for tries need proof points, and chemical hydrogen economy what commercial Email: info@bharatjyotiimpex.com Website: www.bharatjyotiimpex.com

off-site hydrogen pipelines) would plants are ideally sized to provide them. success looks like. MORE THAN 2000 CHEMICALS IN SMALL PACKING

162 Chemical Weekly June 10, 2025 Chemical Weekly June 10, 2025 163

Contents Index to Advertisers Index to Products Advertised