Page 173 - CW E-Magazine (5-8-2025)

P. 173

Special Report Special Report

The next round in th e EU-US tariff battle: What’s the innovator drugs. Europe is the lar-

gest supplier of pharmaceuticals and

impact on API supply? 6% inputs imported into the US for inno-

vator drugs, and the EU is the largest

acing a potential US tariff of and the EU. Both parties had been PATRICIA VAN ARNUM 15% 16% source of these imports.

30% coming due on August 1, in negotiations to reach a trade deal Editorial Director, (DCAT)

FEuropean Union leaders are before an August 1, 2025, deadline 13% 11% Looking at US and ex-US manu-

mapping out a trade strategy. What’s for the imposition of reciprocal taxes negotiated solution with the US 8% 31% 8% facturing of active pharmaceutical

the impact on pharmaceutical supply by the US on the EU. August 1 was reflecting our commitment to dia- 3% ingredients (APIs) on a global basis

chains? the second extension that the US had logue, stability, and a constructive for both innovator/branded and

given before implementing country- transatlantic partnership. We remain 18% generic drugs shows the importance

Next move on by-country tariffs designed to reduce ready to continue working towards 20% of the EU to the US market. The data

Evolving US trade policy took the trade imbalance between the US an agreement by August 1,” she said are based on the U.S. Pharmacopeia

another turn on July 11, 2025 when and its trading partners. in her July 11, 2025, statement. “At Medicine Supply Map, a data intelli-

President Donald Trump announced the same time, we will take all neces- gence platform that maps where 94%

imposing a 30% tariff on European The Trump Administration first sary steps to safeguard EU interests, 32% 43% of US pharmaceutical drug products

Union (EU) exports into the US, effec- laid out a plan for imposing reci- including the adoption of propor- 2% 35% and their ingredients are made and

tive August 1, 2025. In a letter procal tariffs in February 2025 tionate countermeasures if required. that identifies, characterizes, and

to Ursula von der Leyen, President to counter non-reciprocal trading Meanwhile, we continue to deepen 12% 15% 12% predicts supply-chain risk.

of the European Commission, dated arrangements with its trading partners our global partnerships, firmly an-

July 11, 2025, President Trump said and to improve US competitiveness, chored in the principles of rules- On the API side, the USP analysis

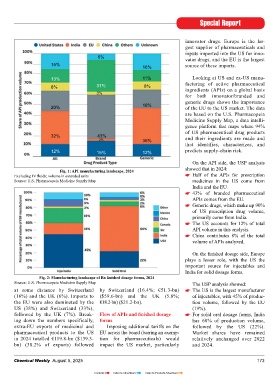

such tariffs would be imposed to including in manufacturing. Those based international trade.” Fig. 1: API manufacturing landscape, 2024 showed that in 2024:

address the US trade defi cit with reciprocal taxes were scheduled to Excluding IV fl uids; volume in extended units Half of the APIs for prescription

the EU and that no tariffs would be go into effect on April 9, 2025, but Impact of tariffs on EU pharma- Source: U.S. Pharmacopeia Medicine Supply Map medicines in the US come from

imposed if the EU or companies in the the Administration placed a 90-day ceuticals India and the EU.

EU decide to build or manufacture pause (until July 9, 2025) on their Medicinal and pharmaceutical 43% of branded pharmaceutical

products in the US. He added that implementation to enable countries products are an important part of the APIs comes from the EU.

if the EU were to impose retaliatory to negotiate these tariffs with the EU’s economy and its position in Generic drugs, which make up 90%

tariffs in response, the US would add US government. The US government global trade. In €2024, EU exports of US prescription drug volume,

the amount of those tariffs in addi- then extended the deadline again, of medicinal and pharmaceutical primarily come from India.

tion to the 30% tariff. this time to August 1, 2025, except products increased by 13.5% com- The US accounts for 12% of total

for 14 countries, which were sent pared with 2023, reaching €313.4-bn API volume in this analysis.

In response, European Commis- letters from the White House to specify ($364.4-bn), according to informa- China contributes 8% of the total

sion President von der Leyen, in tariffs ranging from 25% to 40%. tion from Eurostat, the statistical volume of APIs analyzed.

a statement on July 11, 2025, ac- office of the EU. At the same time,

knowledged the receipt of the letter The US and EU had been in nego- imports only recorded a modest increase On the fi nished dosage side, Europe

sent by President Trump and the tiations to reach a deal on reciprocal of 0.5%, amounting to €119.7-bn plays a lesser role, with the US the

negative impact of such tariffs on taxes prior to the August 1, 2025 ($139.2-bn). Consequently, in 2024, important source for injectables and

the EU. “We take note of the letter extended deadline, but with the US the EU’s trade surplus in medicinal India for solid dosage forms.

Fig. 2: Manufacturing landscape of Rx fi nished dosage forms, 2024

sent by U.S. President Trump outlin- now proposing a 30% tariff on EU and pharmaceutical products came Source: U.S. Pharmacopeia Medicine Supply Map

ing a revised tariff rate and a new goods entering the US, by August 1, to a total of €193.6-bn ($225.1-bn) The USP analysis showed:

timeline,” said von der Leyen, in 2025, what will happen next is the marking a record high. at some distance by Switzerland by Switzerland (16.4%; €51.3-bn) The US is the largest manufacturer

the statement. “Imposing 30 percent large question looming for the EU (16%) and the UK (6%). Imports to ($59.6-bn) and the UK (5.8%; of injectables, with 45% of produc-

tariffs on EU exports would disrupt and US. The US and Switzerland are the the EU were also dominated by the €18.2-bn) ($21.2-bn). tion volume, followed by the EU

essential transatlantic supply chains, main trading partner for the EU in US (38%) and Switzerland (33%), (19%).

to the detriment of businesses, “Few economies in the world pharmaceuticals. The US stands followed by the UK (7%). Break- Flow of APIs and fi nished dosage For solid oral dosage forms, India

consumers and patients on both sides match the European Union’s level of out as the EU’s main trading part- ing down the numbers specifically, forms has 60% of production volume,

of the Atlantic.” openness and adherence to fair trad- ner for medicinal and pharmaceuti- extra-EU exports of medicinal and Imposing additional tariffs on the followed by the US (22%).

ing practices,” said von der Leyen in cal products in 2024. Exports to the pharmaceutical products to the US EU across the board (barring an exemp- Market shares have remained

What will happen next is the large her July 11, 2025, statement. “The US (38%) were almost a two-fifths in 2024 totalled €119.8-bn ($139.3- tion for pharmaceuticals) would relatively unchanged over 2022

question looming for both the US EU has consistently prioritized a of all EU exports and were followed bn) (38.2% of exports) followed impact the US market, particularly and 2024.

172 Chemical Weekly August 5, 2025 Chemical Weekly August 5, 2025 173

Contents Index to Advertisers Index to Products Advertised