Page 195 - CW E-Magazine (13-8-2024)

P. 195

Special Report Special Report

Indian CRO/CDMO businesses to benefi t from passage alternatives. The green shoots are already 35 8 7.6

visible, as over 60% of listed pharma

of US Biosecure Act: Ind-Ra have witnessed an increase in the num- 30 30 7 6 6.2

ber of enquires for new businesses, and

ndian pharma companies operating in entities over the past 12 months. While 33% of them believe that the act, if 25 20 21 23 5 4.4

the contract development and manu- No impact, capex requirements will remain high, implemented, can be a business driver. 20 18 4 3.8

7%

Ifacturing organization (CDMO) and leverage levels will remain consistent with 15 14 14 15 3 3.2

contract research organisation (CRO) the revised ratings,” says Mr. Vivek Jain, Partnering opportunities in CRM/ 10 10 2 2.5 2

segments are likely to reap benefi ts Director, Corporate Ratings, Ind-Ra. CDMO to Gain Traction

from increased orders, stemming from Future A recent report published by L.E.K. 5 1 0.5

New

the passage of the US Biosecure Act, business business US Biosecure Act likely to re-orient Consulting on the Impact of US BIO- 0 0

driver,

from US pharma companies over the 33% enquiries, supply chains, Indian players to gain SECURE Act on Biopharmas, Contract Company 1 Company 2 Company 3 Company 1 Company 2 Company 3

next 12-18 months. Indian companies, 60% Ind-Ra expects the Act, if passed, Services and Investors highlights the FY22 FY23 FY24 FY22 FY23 FY24

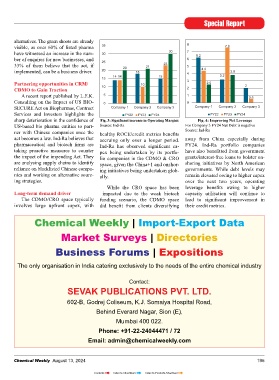

in anticipation, have incurred signi- will lead to re-orientation of supply sharp deterioration in the confi dence of Fig. 3: Signifi cant increase in Operating Margins Fig. 4: Improving Net Leverage

fi cant capex over the past two years, chains, given the restriction on US fede- US-based bio pharma entities to part- Source: Ind-Ra For Company 3 FY24 Net Debt is negative

Source: Ind-Ra

resulting in elevated leverage ratios. ral agencies procuring equipment and ner with Chinese companies once the healthy ROCE/credit metrics benefi ts

services from certain “biotechnology act becomes a law. Ind-Ra believes that accruing only over a longer period. away from China especially during

India Ratings and Research (Ind-Ra) Fig. 1: Indian pharma sess higher new companies of concern,” primarily large pharmaceutical and biotech fi rms are Ind-Ra has observed signifi cant ca- FY24. Ind-Ra portfolio companies

expects the ratio to moderate with the business enquiries Chinese pharma companies. taking proactive measures to counter pex being undertaken by its portfo- have also benefi tted from government

benefi ts of operating leverage feeding Data of 15 listed companies the impact of the impending Act. They lio companies in the CDMO & CRO grants/interest-free loans to bolster on-

into margins and cash fl ows. Source: Ind-Ra analysis, Media Reports, Con-call Consequently, Ind-Ra expects the are analysing supply chains to identify space, given the China+1 and onshor- shoring initiatives by North American

transcripts. reliance on blacklisted Chinese compa-

supply of numerous drugs used in clini- ing initiatives being undertaken glob- governments. While debt levels may

“CDMO players, which were im- during FY24, despite debt levels cal trials and critical raw materials to nies and working on alternative sourc- ally. remain elevated owing to higher capex

pacted due to weaker capacity utili- remaining unchanged, leading to an be impacted, given the trade that most ing strategies. over the next two years, operating

Sation during FY22/FY23 owing to improvement in their credit metrics. pharma companies have with these While the CRO space has been leverage benefi ts owing to higher

higher capex in the past, witnessed Given the expectation that the trend is agencies. This would provide opportu- Long-term demand driver impacted due to the weak biotech capacity utilisation will continue to

operating leverage benefi ts play out likely to sustain, Ind-Ra upgraded three nities for Indian companies to act as The CDMO/CRO space typically funding scenario, the CDMO space lead to signifi cant improvement in

involves large upfront capex, with did benefi t from clients diversifying their credit metrics.

70

60 Chemical Weekly | Import-Export Data

60

55

50 Market Surveys | Directories

50

44

40 Business Forums | Expositions

40

33

30 The only organisation in India catering exclusively to the needs of the entire chemical industry

30

27

22

20 18 Contact:

10 10 SEVAK PUBLICATIONS PVT. LTD.

10

602-B, Godrej Coliseum, K.J. Somaiya Hospital Road,

0 Behind Everard Nagar, Sion (E),

Clinical development CDMOs CROs Commercialisation

Mumbai 400 022.

Likely (7-10) Neither l ikely n oru n likely ( 4-6) Unlikely (0-3)

Fig. 2: US Biopharmas lack interest to partner with Chinese companies for clinical research, development and manufacturing, % Phone: +91-22-24044471 / 72

Survey question: Select, on a scale of 1-10, your likelihood of partnering with Chinese companies in the next three years after the US Biosecure Act (0 is

extremely low and 10 is extremely high) Email: admin@chemicalweekly.com

Source: L.E.K. Global Survey in Impact of US Biosecure Act, Survey of 73 respondents.

194 Chemical Weekly August 13, 2024 Chemical Weekly August 13, 2024 195

Contents Index to Advertisers Index to Products Advertised