Page 170 - CW E-Magazine (24-9-2024)

P. 170

Special Report

sors still have opportunities to find

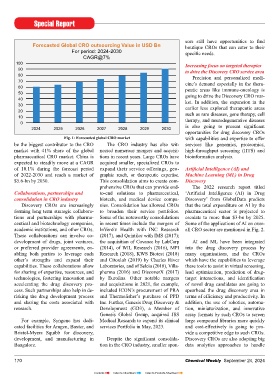

Forecasted Global CRO outsourcing Value in USD Bn boutique CROs that can cater to their

For period: 2024-2030 specific needs.

CAGR@7%

100 Increasing focus on targeted therapies

90 to drive the Discovery CRO service area

80 Precision and personalized medi-

70 cine’s demand especially in the thera-

60 peutic areas like immune-oncology is

50 going to drive the Discovery CRO mar-

40 ket. In addition, the expansion in the

30 earlier less explored therapeutic areas

20 such as rare diseases, gene therapy, cell

10 therapy, and neurodegenerative diseases

0

2024 2025 2026 2027 2028 2029 2030 is also going to present significant

opportunities for drug discovery CROs

Fig. 1: Forecasted global CRO market with capabilities and expertise to offer

be the biggest contributor to the CRO The CRO industry has also wit- services like genomics, proteomics,

market with 41% share of the global nessed numerous mergers and acquisi- high-throughput screening (HTS) and

pharmaceutical CRO market. China is tions in recent years. Large CROs have bioinformatics analysis.

expected to steadily move at a CAGR acquired smaller, specialized CROs to

of 10.1% during the forecast period expand their service offerings, geo- Artificial Intelligence (AI) and

of 2022-2030 and reach a market of graphic reach, or therapeutic expertise. Machine Learning (ML) in Drug

$5.6-bn by 2030. This consolidation aims to create com- Discovery

prehensive CROs that can provide end- The 2022 research report titled

Collaborations, partnerships and to-end solutions to pharmaceutical, ‘Artificial Intelligence (AI) in Drug

consolidation in CRO industry biotech, and medical device compa- Discovery’ from GlobalData predicts

Discovery CROs are increasingly nies. Consolidation has allowed CROs that the total expenditure on AI by the

forming long term strategic collabora- to broaden their service portfolios. pharmaceutical sector is projected to

tions and partnerships with pharma- Some of the noteworthy consolidations escalate to more than $3-bn by 2025.

ceutical and biotechnology companies, in recent times include the mergers of Some of the applications of AI on over-

academic institutions, and other CROs. InVentiv Health with INC Research all CRO sector are mentioned in Fig. 2.

These collaborations can involve co- (2017), and Quintiles with IMS (2017);

development of drugs, joint ventures, the acquisition of Covance by LabCorp AI and ML have been integrated

or preferred provider agreements, en- (2014), of WIL Research (2016), MPI into the drug discovery process by

abling both parties to leverage each Research (2018), KWS Biotest (2018) many organisations, and the CROs

other’s strengths and expand their and Citoxlab (2019) by Charles River which have the capabilities to leverage

capabilities. These collaborations allow Laboratories, and of Selcia (2018), Villa- these tools to assist in virtual screening,

for sharing of expertise, resources, and pharma (2016) and DiscoverX (2017) lead optimization, prediction of drug-

technologies, fostering innovation and by Eurofins. Other notable mergers target interactions, and identification

accelerating the drug discovery pro- and acquisitions in 2021, for example, of novel drug candidates are going to

cess. Such partnerships also help in de- included ICON’s procurement of PRA spearhead the drug discovery area in

risking the drug development process and Thermofisher’s purchase of PPD terms of efficiency and productivity. In

and sharing the costs associated with Inc. Further, Genesis Drug Discovery & addition, the use of robotics, automa-

research. Development (GD3), a Member of tion, miniaturization, and innovative

Genesis Global Group, acquired JSS assay formats by such CROs to screen

For example, Syngene has dedi- Medical Research to expand its clinical large compound libraries more quickly

cated facilities for Amgen, Baxter, and services Portfolio in May, 2023. and cost-effectively is going to pro-

Bristol-Myers Squibb for discovery, vide a competitive edge to such CROs.

development, and manufacturing in Despite the significant consolida- Discovery CROs are also adopting big

Bangalore. tion in the CRO industry, smaller spon- data analytics approaches to handle

170 Chemical Weekly September 24, 2024

Contents Index to Advertisers Index to Products Advertised