Page 180 - CW E-Magazine (10-9-2024)

P. 180

Special Report Special Report

Li-ion cell market to touch $400-bn by 2035, performance-oriented EVs or other production particularly concentrated However, signifi cant opportunities

applications requiring high energy in the region. While excitement builds exist in other applications and mar-

but challenges remain densities and long runtimes. for new anode materials, graphite kets. These include a variety of diffe-

remains the dominant material used rent vehicle classes, from large electric

In line with the broader market, for Li-ion anodes. IDTechEx estimates trucks and mining vehicles to electric

he global lithium (Li)-ion bat- sumers, it has also impacted margins Dr. Alex Holland cathode prices, including for LFP and close to 99% of total anode material two- and three-wheelers, through to

tery cell market will reach and exacerbated the diffi culty of new NMC materials, have fallen substanti- used in Li-ion batteries is graphite. grid-scale and residential battery

Tover $400-bn by 2035, as per entrants succeeding in the Li-ion Research Director, IDTechEx ally from early 2023 due to sharp energy storage systems, each with

a new market report, ‘Li-ion Battery market. To reduce reliance on a single reductions in lithium and raw mate- Applications and markets their own performance priorities, not

Market 2025-2035: Technologies, region and develop domestic battery rial prices, as well as overcapacity and Battery electric cars have been one all of which can be satisfactorily met

Players, Applications, Outlooks and Cell manufacturing and the Li-ion manufacturing capabilities, Europe and competition. of the key drivers behind growth in by current generation batteries.

Forecasts’. market North America are attempting to foster Li-ion demand over the past 10 years

Given the rapid increase in forecast domestic supply chains. In the US, At the anode, new materials, especi- and are forecast to remain the domi- The stationary sector has seen rapid

While there has been strong growth demand for Li-ion batteries over the the Infl ation Reduction Act (IRA) an- ally silicon-oxide and silicon-carbon nant driver of Li-ion battery demand. year-on-year growth due to increased

in the stationary battery sector, electric past fi ve years, there has been signi- nouncement led to a fl urry of giga- composites, continue to garner interest Developments and innovations conti- deployment of renewable energy onto

vehicles (EVs) remain the key driver fi cant growth in the number of giga- factory and investment announcements. due to their potential to improve nue to be made in Li-ion anode and electricity grids and particularly fast

behind the Li-ion market, and electric factories brought online as well as those Prior to the IRA, IDTechEx estimated energy density despite issues regarding cathode materials, manufacturing, cell drops in stationary battery prices.

cars will be the largest market for being planned and announced. Much that approximately 600-GWh of battery cycle life and lifetime. The potential design, and pack design, all contri- Longer lifetime and higher capacity

Li-ion batteries over the next 10 years. of this has been driven by incumbent cell capacity would be located in to establish supply chains for silicon buting to improved performance and containerized storage systems offer a

Although there are some regional manufacturers such as CATL, BYD, North America by 2030 with this fi gure anodes outside of China represents price points and the general positive glimpse into the continued innovation

concerns over the rate of EV adoption LG Energy Solution, SK Innovation, growing to 850-GWh in IDTechEx’s another potential benefi t, with anode outlook for EVs. going into Li-ion battery systems.

in 2024, sales of EVs grew rapidly in and Samsung SDI, along with a latest analysis. In Europe, the reality

2022 and 2023, and the medium-long- number of fast-growing Chinese manu- of scaling production rapidly, compet-

term outlook for EV adoption remains facturers. ing with established Asian players, and

strong. some slower than expected demand has Chemical Weekly Buyers’ Guide

IDTechEx estimates that the majo- inhibited recent investment and expan-

2023 and 2024 have also seen rity of cell production is located in China, sion plans. Challenges remain in esta- www.cwbg.in

substantial declines in battery prices, a trend common across the Li-ion blishing robust battery supply chains www.cwbg.in

driven by lower raw material prices, value chain where Chinese companies in America and Europe. Pocket-Friendly Pay-as-you-use Subscription Plans

production overcapacity, and strong control much of the market for anodes,

competition throughout the supply cathodes, electrolytes, separators, and Anodes and cathodes Opt for a scheme that suits your needs and make best use of India’s most authentic directory

chain. While this is benefi cial to con- copper current collectors. The anode and cathode materials, for sourcing chemicals and related products.

which ultimately defi ne the perfor-

mance of a Li-ion battery, continue to Subscription plans

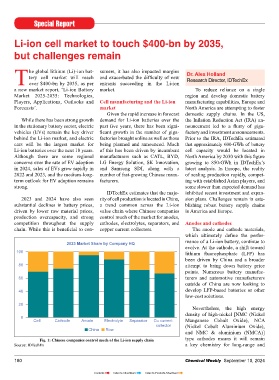

2023 Market Share by Company HQ

evolve. At the cathode, a shift toward Plan Hours of usage INR* USD*

100 lithium fl uorophosphate (LFP) has Plan 25 25 1,500 25

been driven by China and a broader Plan 50 50 2,500 50 Web-Based

80 attempt to bring down battery price Plan 100 100 4,500 75

points. Numerous battery manufac- Directory

60 turers and automotive manufacturers Plan 150 150 6,000 100 on Indian

outside of China are now looking to *Plus GST @ 18% applicable Chemical Industry

40 develop LFP-based batteries or other For more information or for a FREE trial contact: and Trade

low-cost solutions.

20 Mr. Kiran Iyer Mr. Abhishek Vora

Nevertheless, the high energy

density of high-nickel [NMC (Nickel kiran@chemicalweekly.com abhi@chemicalweekly.com Chemicals & Search & download

0

Cell Cathode Anode Electrolyte Separator Cu current Manganese Cobalt Oxide), NCA Chemical Weekly Database Pvt. Ltd. related products / data on 8,500+

collector (Nickel Cobalt Aluminium Oxide), Equipment & Manufacturers /

China Row 602-B, Godrej Coliseum, K.J. Somaiya Hospital Road,

and NMC & aluminium (NMCA)] Behind Everard Nagar, Sion (E), Mumbai - 400 022. Instrumentation / Dealers / Indentors /

Fig. 1: Chinese companies control much of the Li-ion supply chain type cathodes means it will remain Phone: +91-22-24044471 72 Consultants Merchant Exporters

Source: IDTechEx a key chemistry for long-range and

180 Chemical Weekly September 10, 2024 Chemical Weekly September 10, 2024 181

Contents Index to Advertisers Index to Products Advertised