Page 16 - CW E-Magazine (Oct-Nov-2023)

P. 16

Indian APIs

29%

26%

25%

25%

24%

24%

24%

23%

23%

24%

21%

20%

20%

20%

20%

19%

19%

18%

18%

17%

FY21

FY17

FY14

FY23

FY18

FY20

FY16

FY19

FY22

FY15

FY13

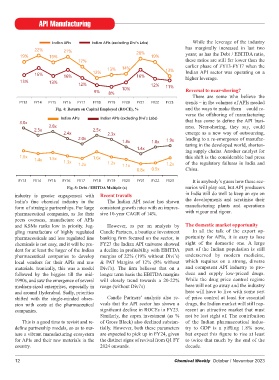

Fig. 2a: EBITDA margins, %

Indian APIs (excluding Divi’s Labs)

Indian APIs

18%

17%

15%

14%

14%

14%

14%

13%

13%

12%

12%

13%

10%

9%

9% Indian APIs (excluding Divi’s Labs) 28% 22%

8% 8% 8% 8%

7% 8% 7%

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23

API Manufacturing

Fig. 2b: EBITDA margins, %

While the leverage of the industry

Indian APIs Indian APIs (excluding Divi’s Labs)

has marginally increased in last two

22% 21%

19% 19% 20% 19% years; as has the Debt / EBITDA ratio, Bharat Jyoti Impex

17% these ratios are still far lower than the

earlier phase of FY13-FY17 when the AVAILABLE REGULARLY

13% 14% 13%

12% Indian API sector was operating on a

16%

16% 16% higher leverage. 3-Amino Benzoic Acid 4 Amino Phenol Acetophenone Methyl Cyclohexane Methyl Salicylate

13% 13% Acetyl Acetone Acrylonitrile Adipic Acid Allyl Alcohol Methyl Isobutyl Carbinol (MIBC) Methyl Propyl Ketone

12% 12% 11% Allyl Chloride Allylamine Alpha-Methyl Styrene Methyl Tin Mercaptide Monoglyme / Diglyme

10% Reversal to near-shoring?

9% 8% Amino Ethyl Ethanol Amine Amino Guanidine Bicarbonate N,N-Dicyclohexyl Carbodiimide N,O-Bis (Tri Methyl Silyl) Acetamide

There are some who believe the Antimony Trioxide 99.8% Azelaic Acid 1,2,3-Benzotriazole N-Amyl Alcohol (N-Pentyl Alcohol) N-Butyl Amine

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 trends – in the volumes of APIs needed 1,3-Butane Diol Biphenyl Boron Trifluoride Etherate N Butyraldehyde (Needle / Crystal) N-Decanol

D-Camphor Sulphonic Acid Cerium Oxide Cetyl Chloride

N-Hexanol 99% (Nacol - C6) N-Methyl Piperazine Nitro Ethane

Fig. 4: Return on Capital Employed (ROCE), % and the ways to make them – could re- CIS-2-Butene-1,4-Diol Cyclohexanol 2,4 Di Tertiary Butyl Phenol 1-Octanol (C8) 1-Octene 2-Pyrrolidone Para Benzoquinone

verse the offshoring of manufacturing 2,2-Dimethoxy Propane Dibromomethane (Methylene Di Bromide) Para Chlorobenzaldehyde Para Hydroxybenzaldehyde

Indian APIs Indian APIs (excluding Divi’s Labs) that has come to define the API busi- Di Ethyl Malonate Di Ethyl Sulphate Di Methyl Malonate Pelargonic Acid Phosphorous Pentoxide Pyrrolidine

3.0x Di Phenyl Carbonate DIBOC (Di Tert. Butyl Dicarbonate) Resorcinol (China) Salicylic Acid Technical / Pure

2.8x ness. Near-shoring, they say, could

2.5x 2.5x Diethyl Oxalate Dicyclopentadiene Diisopropyl Succinate Selenium Dioxide Stearyl Bromide Sulfolane Anhydrous

2.4x 2.3x emerge as a new way of outsourcing, DMSO (Hubei Xingfa) 2 Ethyl Hexyl Bromide Secondary Butanol (China) Selenium Metal Powder 99.9%

2.0x 1.9x leading to a re-emergence of manufac- 2-Ethyl Hexyl Thioglycolate Ethyl Acrylate (Satellite-China) Sodium Ethoxide Sodium Methoxide

1.8x 1.8x

turing in the developed world, shorten- Ethyl Acrylate (Formosa-Taiwan) Ethyl Benzene Sodium Sulphite (Aditya Birla - Thailand) Succinic Acid

1.4x Ethyl Cyclo Hexane Formamide Formic Acid 99% Strontium Carbonate 1,2,4-Triazole Sodium Salt

ing supply chains. Another catalyst for Fumaric Acid Gamma Butyrolactone Glycolic Acid 70% D - Tartaric Acid Tert. Butyl Amine Tertiary Butyl Acetate

1.6x 1.6x this shift is the considerable bad press Glyoxal 40% Glyoxylic Acid 50% Guanidine HCl Guanine Tertiary Amyl Alcohol THF (Dairen, Nan Ya) Thioacetamide

1.4x 1.5x

1.3x 1.2x of the regulatory failures in India and 1,6-Hexane Diol Hippuric Acid Imidazole Isobutylamine Thiocyanates: Ammonium / Sodium / Potassium Thioglycolic Acid

1.2x 1.1x 1.2x

0.8x 0.9x China. Isovaleraldehyde Itaconic Acid L + Tartaric Acid Lactic Acid TMOF / TEOF / TMO Acetate Tri Ethyl Citrate Triethylsilane

Lithium Amide Lithium Aluminium Hydride Lithium Carbonate Tri Fluoro Acetic Acid 2,2,2 Tri Fluoro Ethanol

Lithium Hydroxide Lithium Metal 99% / 99.9% Tri Isodecyl Stearate Tolyl Triazole

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 It is anybody’s guess how these sce- 1-Methyl Imidazole 2-Methyl Imidazole 2-Methyl THF Malonic Acid 2,6-Xylidine Zinc Chloride Anhydrous 99% China

Fig. 5: Debt / EBITDA Multiple (x) narios will play out, but API producers NACOL 6 99% (N HEXANOL), NACOL 8 99% (N OCTANOL),

industry is greater engagement with Recent travails in India will do well to keep an eye on

India’s fine chemical industry in the The Indian API sector has shown the developments and scrutinise their NACOL 10 99% (N DECANOL) SASOL GERMANY

form of strategic partnerships. For large consistent growth rates with an impres- manufacturing plants and operations Meta Para Cresol [Meta 60%] / Para Cresol / Meta Cresol 99.5% /

pharmaceutical companies, as for their sive 10-year CAGR of 14%. with vigour and rigour. Fluorobenzene / Tetra Hydro Furfuryl Alcohol / Tri Fluoro Acetic Anhydride

peers overseas, manufacture of APIs Cyclopentanone / Di Methyl Acetamide [Henan Junhua] / Pelargonic Acid (Nonanoic Acid)

and KSMs ranks low in priority. Jug- However, as per an analysis by The domestic market opportunity Amines : Allylamine / Di Cyclohexylamine / Diisopropylamine / Di Allyl Amine /

gling manufacture of highly regulated Candle Partners, a boutique investment In all the talk of the export op- Di-N-Propyl Amine / Tert. Butyl Amine / DL Alfa Phenyl Ethyl Amine /

pharmaceuticals and less regulated fine banking firm focused on the sector, in portunity for APIs, it is easy to lose Isobutylamine / Monocyclohexylamine / N-Butyl Amine / Furfurylamine /

chemicals is not easy, and it will be pru- FY23 the Indian API universe showed sight of the domestic one. A large Mono Ethyl Amine 70% / Diethyl Hydroxylamine

dent for at least the larger of the Indian a decline in profitability with EBITDA part of the Indian population is still Oleo Chemicals: Lauric / Myristic / Palmitic / Oleic / DCFA / Caproic / Capric /

pharmaceutical companies to develop margins of 22% (19% without Divi’s) underserved by modern medicine, Caprylic Acid / Methyl Stearate / 12 Hydroxy Stearic Acid

local vendors for their APIs and raw & PAT Margins of 12% (8% without which requires on a strong, diverse PETROLEUM ETHERS

materials. Ironically, this was a model Divi’s). The firm believes that on a and competent API industry to pro-

followed by the biggies till the mid- longer term basis the EBITDA margins duce and supply low-priced drugs. 40-60 / 60-80 / 80-100 / 100-120 ETC.

: MFGD BY :

1990s, and saw the emergence of several will closely trend towards a 20-22% While the drug price control regime M/S. Pradeep Shetye Pvt. Ltd. MIDC Mahad 402301

medium-sized enterprises, especially in range (without Divi’s) here will not go away and the industry

and around Hyderabad. Sadly, priorities here will have to live with some sort Water Treatment Chemicals: Trichloroisocyanuric Acid / Sodium Dichloroisocyanurate (56%) Granule /

shifted with the single-minded obses- Candle Partners’ analysis also re- of price control at least for essential 1,2,3 Benzotriazole 99.5% / Tolyltriazole Granular / Glutaraldehyde 50%

sion with costs at the pharmaceutical veals that the API sector has shown a drugs, the Indian market will still rep- Foundry / Casting Industries: Furfuryl Alcohol / Furfuraldehyde / Triacetin (Glycerine Triacetate) / Dibasic Ester /

companies. significant decline in ROCEs in FY23. resent an attractive market that must Ethylene Glycol Diacetate (EGDA) / Tri-N-Butyl Phosphate / Triisobutyl Phosphate

Similarly, the capex investment (as % not be lost sight of. The contribution PvC Stabiliser: 2-Ethylhexyl Thioglycolate / Thioglycolic Acid 80% / Methyl Tin Mercaptide

This is a good time to revisit and re- of Gross Block) also declined substan- of the Indian pharmaceutical indus- Bharat Jyoti Impex

define partnership models, so as to nur- tially. However, both these parameters try to GDP is a piffling 1.8% now, “Jasu”, Ground Floor, 30, Dadabhai Road, (Near CNM School), Vile Parle (West), Mumbai 400 056.

ture a vibrant manufacturing ecosystem are expected to pick up in FY24, given but expect this figure to rise at least Tel.: +91-22-2623 3434 Fax: 2623 3737 Email: info@bharatjyotiimpex.com

for APIs and their raw materials in the the distinct signs of revival from Q1 FY to twice that much by the end of the Website: www.bharatjyotiimpex.com

country. 2024 onwards. decade. More than 2000 CheMiCals in sMall PaCking

12 Chemical Weekly October / November 2023