Page 15 - CW E-Magazine (Oct-Nov-2023)

P. 15

API Manufacturing

heterogeneous, and electro-catalysis. 28% 27% 282

While the choice of catalytic technique 25% 268

employed for a transformation will de- 232

pend on the target molecule, the avail- 21%

ability of different catalysts at industrial 183

scale, the ability to develop appropriate 15% 166 16%

analytical methods and, of course, cost, 124 131 137

there is no denying that biocatalysts are 95 109

set for greater deployment commercially. 75 13%

6% 10%

5% 5%

While the decision to invest in new

‘Bulk Drug Parks’ is welcome, fiscal

support to technology improvements

FY18

FY21

FY19

FY20

FY22

FY15

FY14

FY17

FY16

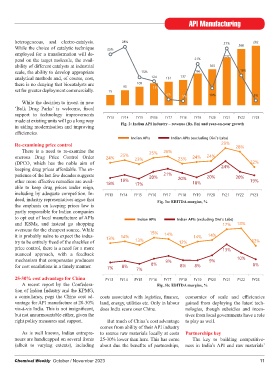

made at existing units will go a long way FY13 Fig. 2: Indian API industry – revenue (Rs. Bn) and year-on-year growth FY23

in aiding modernisation and improving

efficiencies. Indian APIs Indian APIs (excluding Divi’s Labs)

Indian APIs Indian APIs (excluding Divi’s Labs)

29%

Re-examining price control 29% 28%

28%

There is a need to re-examine the 25% 25% 26% 24%

26%

onerous Drug Price Control Order 24% 25% 23% 25% 23% 24% 24% 22%

24%

24%

23%

23%

(DPCO, which has the noble aim of 24% 22%

keeping drug prices affordable. The ex- 21% 24%

perience of the last few decades suggests 19% 20% 21% 20% 20% 20%

20%

20% 19%

20%

other more effective remedies are avail- 18% 19% 17% 20% 18% 19%

18%

18%

able to keep drug prices under reign, 17%

including by adequate competition. In- FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23

FY19

FY14

FY20

FY21

FY15

FY17

FY18

FY23

FY22

FY16

FY13

deed, industry representatives argue that Fig. 2a: EBITDA margins, % Fig. 3a: EBITDA margins, %

Fig. 2a: EBITDA margins, %

the emphasis on keeping prices low is

partly responsible for Indian companies

to opt out of local manufacture of APIs Indian APIs Indian APIs (excluding Divi’s Labs)

and KSMs, and instead go shopping Indian APIs Indian APIs (excluding Divi’s Labs) 18%

17%

overseas for the cheapest source. While 17% 18%

it is probably naïve to expect the indus- 13% 14% 15% 14% 14% 14%

15%

try to be entirely freed of the shackles of 13% 14% 13% 14% 12% 14% 14% 12%

price control, there is a need for a more 13% 12% 13% 12%

nuanced approach, with a feedback 13%

mechanism that compensates producers 9% 9% 10%

for cost escalations in a timely manner. 7% 8% 8% 9% 8% 8% 9% 10% 8%

8%

7% 8% 7% 8% 8% 8%

7%

25-30% cost advantage for China FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23

A recent report by the Confedera- FY13 FY14 FY15 FY16 Fig. 3b: EBITDA margins, % FY20 FY21 FY22 FY23

FY18

FY17

FY19

tion of Indian Industry and the KPMG, Fig. 2b: EBITDA margins, %

a consultancy, pegs the China cost ad- Fig. 2b: EBITDA margins, % logistics, finance, economies of scale and efficiencies

costs associated with

vantage for API manufacture at 20-30% land, energy, utilities etc. Only in labour gained from deploying the latest tech-

vis-à-vis India. This is not insignificant, does India score over China. nologies, though subsidies and incen-

but not unsurmountable either, given the Indian APIs Indian APIs (excluding Divi’s Labs)

tives from local governments have a role

Indian APIs (excluding Divi’s Labs)

Indian APIs

right policy measures and support. But much of China’s cost advantage to play as well. 20%

22%

21%

comes from ability of their API industry 20% 19%

22%

21%

19%

19%

As is well known, Indian entrepre- to source raw materials locally at costs Partnerships key 19%

17%

19%

19%

17%

neurs are handicapped on several fronts 25-30% lower than here. This has come The 14% 13%

13% key to building competitive-

12%

(albeit to varying extents), including about due the benefits of partnerships, ness in India’s API and raw materials’

14%

16%

13%

16%

16%

13%

12%

13% 16% 13% 16% 16%

13% 13% 12% 12% 11%

Chemical Weekly October / November 2023 12% 9% 10% 12% 11

8% 10% 11%

9% 8%

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23

FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23