Page 180 - CW E-Magazine (6-5-2025)

P. 180

Special Report

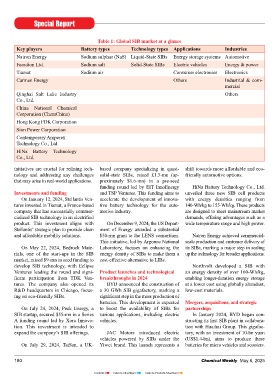

Table 1: Global SIB market at a glance

Key players Battery types Technology types Applications Industries

Natron Energy Sodium sulphur (NaS) Liquid-State SIBs Energy storage systems Automotive

Faradion Ltd. Sodium salt Solid-State SIBs Electric vehicles Energy & power

Tiamat Sodium air Consumer electronics Electronics

Carmen Energy Others Industrial & com-

mercial

Qinghai Salt Lake Industry Others

Co., Ltd.

China National Chemical

Corporation (ChemChina)

Hong Kong FDK Corporation

Sion Power Corporation

Contemporary Amperex

Technology Co., Ltd.

HiNa Battery Technology

Co., Ltd.

initiatives are crucial for refi ning tech- based company specializing in quasi- shift towards more affordable and eco-

nology and addressing any challenges solid-state SIBs, raised £1.3-mn (ap- friendly automotive options.

that may arise in real-world applications. proximately $1.6-mn) in a pre-seed

funding round led by EIT InnoEnergy HiNa Battery Technology Co., Ltd.

Investments and funding and TSP Ventures. This funding aims to unveiled three new SIB cell products

On January 12, 2024, Stellantis Ven- accelerate the development of innova- with energy densities ranging from

tures invested in Tiamat, a France-based tive battery technology for the auto- 140-Wh/kg to 155-Wh/kg. These products

company that has successfully commer- motive industry. are designed to meet mainstream market

cialized SIB technology in an electrifi ed demands, offering advantages such as a

product. This investment aligns with On December 9, 2024, the US Depart- wide temperature range and high power.

Stellantis’ strategic plan to provide clean ment of Energy awarded a substantial

and affordable mobility solutions. $50-mn grant to the LENS consortium. Natron Energy achieved commercial-

This initiative, led by Argonne National scale production and customer delivery of

On May 22, 2024, Bedrock Mate- Laboratory, focuses on enhancing the its SIBs, marking a major step in scaling

rials, one of the start-ups in the SIB energy density of SIBs to make them a up the technology for broader applications.

market, raised $9-mn in seed funding to cost-effective alternative to LIBs.

develop SIB technology, with Eclipse Northvolt developed a SIB with

Ventures leading the round and signi- Product launches and technological an energy density of over 160-Wh/kg,

fi cant participation from TDK Ven- breakthroughs in 2024 enabling longer-duration energy storage

tures. The company also opened its BYD announced the construction of at a lower cost using globally abundant,

R&D headquarters in Chicago, focus- a 30 GWh SIB gigafactory, marking a low-cost materials.

ing on eco-friendly SIBs. signifi cant step in the mass production of

batteries. This development is expected Mergers, acquisitions, and strategic

On July 24, 2024, Peak Energy, a to boost the availability of SIBs for partnerships

SIB startup, secured $55-mn in a Series various applications, including electric In January 2024, BYD began con-

A funding round led by Xora Innova- vehicles. structing its fi rst SIB plant in collabora-

tion. This investment is intended to tion with Huaihai Group. This gigafac-

expand the company’s SIB offerings. JAC Motors introduced electric tory, with an investment of 10-bn yuan

vehicles powered by SIBs under the (US$1.4-bn), aims to produce these

On July 29, 2024, TaiSan, a UK- Yiwei brand. This launch represents a batteries for micro vehicles and scooters.

180 Chemical Weekly May 6, 2025

Contents Index to Advertisers Index to Products Advertised