Page 181 - CW E-Magazine (12-3-2024)

P. 181

Special Report

Risk assessment and mitigation strategies for

businesses in the chemical sector

ndia – a $7-trillion economy. That’s indicates that the business poses KAUSHAL SAMPAT

the vision the government has set an Average Credit Risk. Due to the Founder

Ifor the country to achieve in the current geopolitical risks (Israel/ Rubix Data Sciences

next six years. To achieve this target, Gaza; Red Sea attacks by Houthis

every sector in India’s economy will that disrupt shipping; continued across companies and geographies

have to step up. All eyes are on the conflict between Russia and Ukraine; can help mitigate this risk by spread-

chemicals sector, considering the usage etc.), the external risk environment ing credit risk across multiple buyers.

of chemicals across diverse industries is volatile. It is, therefore, imperative

and in the everyday lives of people. for companies to conduct risk Non-availability of foreign exchange

As per the Government, the size of the assessments of their counterparties in buyers’ countries

chemical sector was $220-bn in 2023, around the world regularly to manage Lately, several countries, including

and it is projected to grow to $383-bn and mitigate risks. Egypt, Pakistan, Ghana, Lebanon,

by 2030. Where there is such a high Bangladesh, Malawi, Ukraine, Tunisia,

growth, there are bound to be risks, Here are some of the most impor- Sri Lanka, and Gambia, have been

particularly, credit, supplier, and com- tant risks that companies in the chemi- facing severe shortages of foreign ex-

pliance risks. cal sector must factor into their risk change. Consequently, even if buyers

management plans along with some in these countries want to make timely

Credit risk of chemical sector com- actions to mitigate them: payments to Indian chemical suppliers,

panies in FY24 they are unable to do so due to forex

While assessing the credit risk Credit risk shortages. Hence, it is imperative for

of 3,895 chemical sector businesses For companies in the chemical sec- Indian chemical exporters to plan their

in FY 2024 (YTD) versus FY 2023, tor, where large investments, long-term cash flows to account for significant

Rubix Data Sciences found that the contracts, and complex supply chains delays in receiving funds from buyers

credit risk has broadly remained are the norm, effectively managing in impacted countries.

unchanged. When measured on a credit risk is crucial for sustainable

100-point scale (0 = Highest Risk; growth and profitability. Delayed payments due to ambiguous

100 = Lowest Risk) the median credit policies and terms

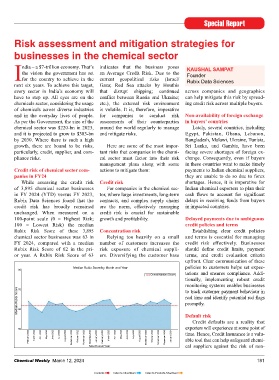

Rubix Risk Score of these 3,895 Concentration risk Establishing clear credit policies

chemical sector businesses was 63 in Relying too heavily on a small and terms is essential for managing

FY 2024, compared with a median number of customers increases the credit risk effectively. Businesses

Rubix Risk Score of 62 in the pri- risk exposure of chemical suppli- should define credit limits, payment

or year. A Rubix Risk Score of 63 ers. Diversifying the customer base terms, and credit evaluation criteria

upfront. Clear communication of these

Median Rubix Score by Month and Year policies to customers helps set expec-

80

Overall Median Score tations and ensures compliance. Addi-

tionally, implementing robust credit

monitoring systems enables businesses

Median Rubix Score 60 real time and identify potential red flags

70

to track customer payment behaviour in

promptly.

Default risk

Credit defaults are a reality that

exporters will experience at some point of

50

February-2022 March-2022 April-2022 May-2022 June-2022 July-2022 August-2022 September-2022 October-2022 November-2022 December-2022 January-2023 February-2023 March-2023 April-2023 May-2023 June-2023 July-2023 August-2023 September-2023 October-2023 November-2023 December-2023 January-2024 time. Hence, Credit Insurance is a valu-

able tool that can help safeguard chemi-

Month and Year cal suppliers against the risk of non-

Chemical Weekly March 12, 2024 181

Contents Index to Advertisers Index to Products Advertised