Page 164 - CW E-Magazine (29-7-2025)

P. 164

News from Abroad

ENERGY TRANSITION CHALLENGES

New energy realities could extend coal’s role in global

energy markets: Report

Global coal demand could remain

stronger for longer, with coal-fi red

power generation potentially staying

dominant through 2030, well beyond

current projections for peak coal, ac-

cording to a new ‘Horizons’ report from

leading consultancy, Wood Mackenzie.

The report titled ‘Staying power:

How new energy realities risk extend-

ing coal’s sunset’ suggests that a confl u-

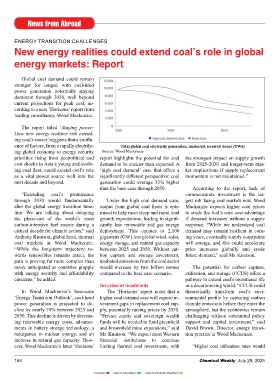

ence of factors, from a rapidly electrify- Total global coal electricity generation, unabated, terawatt hours (TWh)

ing global economy to energy security Source: Wood Mackenzie

priorities rising from geopolitical and report highlights the potential for coal the strongest impact on supply growth

cost shocks to Asia’s young and evolv- demand to be stickier than expected. A from 2025-2030 and longer-term mar-

ing coal fl eet, could extend coal’s role ‘high coal demand’ case that off ers a ket implications if supply replacement

as a vital power source well into the signifi cantly diff erent perspective: coal momentum is not maintained.”

next decade and beyond. generation could average 32% higher

than the base case through 2050. According to the report, lack of

“Extending coal’s prominence commensurate investment is the lar-

through 2030 would fundamentally Under the high coal demand case, gest risk facing coal markets now. Wood

alter the global energy transition time- output from global coal fl eets is opti- Mackenzie expects higher coal prices

line. We are talking about delaying mised to help meet steep and rapid load to erode the fuel’s core cost advantage

the phase-out of the world’s most growth expectations, leading to signifi - if demand increases without a supply

carbon-intensive fuel source during a cantly less renewable and gas energy response. “While we understand coal

critical decade for climate action,” said deployment. This equates to 2,100 demand may remain resilient in com-

Anthony Knutson, global head, thermal gigawatts (GW) less global wind, solar, ing years, eventually supply constraints

coal markets at Wood Mackenzie. energy storage, and natural gas capacity will emerge, and this could accelerate

“While the long-term trajectory to- between 2025 and 2050. Without car- price increases globally and erode

wards renewables remains intact, the bon capture and storage investment, future demand,” said Mr. Knutson.

path is proving far more complex than unabated emissions from the coal sector

many anticipated as countries grapple would increase by two billion tonnes The potential for carbon capture,

with energy security and aff ordability compared to the base case scenario. utilisation, and storage (CCUS) off ers a

concerns,” he added. pathway to extend coal’s operational life

Investment headwinds in a decarbonising world. “CCUS could

In Wood Mackenzie’s base-case The ‘Horizons’ report notes that a theoretically transform coal’s envi-

‘Energy Transition Outlook’, coal-fi red higher coal demand case will expose in- ronmental profi le by capturing carbon

power generation is projected to de- vestment gaps in replacement coal sup- dioxide emissions before they enter the

cline by nearly 70% between 2025 and ply, potentially raising prices by 2030. atmosphere, but the economics remain

2050. This decline is driven by decreas- “Private equity and sovereign wealth challenging without substantial policy

ing renewable energy costs, advance- funds will be needed to fund greenfi eld support and capital investment,” said

ments in battery storage technology, a and brownfi eld mine expansions,” said David Brown, Director, energy transi-

resurgence in nuclear energy, and an Mr. Knutson. “We expect most Western tion practice at Wood Mackenzie.

increase in natural gas capacity. How- fi nancial institutions to continue

ever, Wood Mackenzie’s latest ‘Horizons’ limiting thermal coal investments, with “Higher coal utilisation rates would

164 Chemical Weekly July 29, 2025

Contents Index to Advertisers Index to Products Advertised