Page 186 - CW E-Magazine (15-7-2025)

P. 186

Special Report

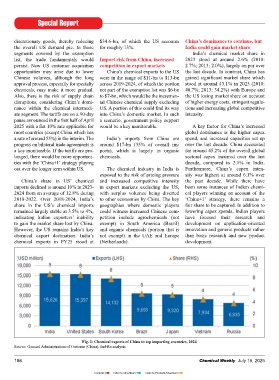

discretionary goods, thereby reducing $34.6-bn, of which the US accounts China’s dominance to continue, but

the overall US demand pie. In those for roughly 13%. India could gain market share

segments covered by the exemption India’s chemical market share in

list, the trade fundamentals would Import risk from China, increased 2023 stood at around 2.6% (2018:

persist. New US customer acquisition competition in export markets 2.7%; 2013: 2.0%), largely on par over

opportunities may arise due to lower China’s chemical exports to the US the last decade. In contrast, China has

Chinese volumes, although the long were in the range of $11-bn to $13-bn gained signifi cant market share which

approval process, especially for specialty across 2019-2024, of which the portion stood at around 43.1% in 2023 (2018:

chemicals, may make it more gradual. not part of the exemption list was $6-bn 40.7%; 2013: 34.2%) with Europe and

Also, there is the risk of supply chain to $7-bn, which would be the incremen- the US losing market share on account

disruptions, considering China’s domi- tal Chinese chemical supply excluding of higher energy costs, stringent regula-

nance within the chemical intermedi- US. A portion of this could fi nd its way tions and increasing global competitive

ate segment. The tariffs are on a 90-day into China’s domestic market. In such intensity.

pause announced in the fi rst half of April a scenario, government policy support

2025 with a fl at 10% rate applicable for would be a key monitorable. A key factor for China’s increased

most countries (except China which has global dominance is the higher capex

a rate of around 55%) in the interim. The India’s imports from China are spend, and increased capacities set up

progress on bilateral trade agreements is around $17-bn (35% of overall im- over the last decade. China accounted

a key monitorable. If the tariffs are pro- ports), which is largely in organic for around 45.2% of the overall global

longed, there would be more opportuni- chemicals. sectoral capex incurred over the last

ties with the ‘China+1’ strategy playing decade, compared to 2.1% in India.

out over the longer term within US. The chemical industry in India is Furthermore, China’s capex inten-

exposed to the risk of pricing pressure sity was highest at around 6.1% over

China’s share in US’ chemical and increased competitive intensity the past decade. While there have

imports declined to around 10% in 2023- in export markets excluding the US, been some instances of Indian chemi-

2024 from an average of 12.8% during with surplus volumes being diverted cal players winning on account of the

2018-2022. Over 2018-2024, India’s to other economies by China. The key ‘China+1’ strategy, there remains a

share in the US’s chemical imports geographies where domestic players fair share to be captured. In addition to

remained largely stable at 3.5% to 4%, could witness increased Chinese com- lowering capex spends, Indian players

indicating Indian exporters’ inability petition include agrochemicals (not have focused their research and

to gain the market share lost by China. exempt) in South America (Brazil) development on application-oriented

However, the US remains India’s key and organic chemicals (portion that is innovation and generic products rather

chemical export destination. India’s not exempt) in the UAE and Europe than basic research and new product

chemical exports in FY25 stood at (Netherlands). development.

Fig. 2: Chemical exports of China to top importing countries, 2024

Source: General Administration of Customs (China), Ind-Ra analysis

186 Chemical Weekly July 15, 2025

Contents Index to Advertisers Index to Products Advertised