Page 159 - CW E-Magazine (26-11-2024)

P. 159

News from Abroad

MARKET TRENDS

‘Global battery manufacturing equipment market

to reach $30-bn by 2029’

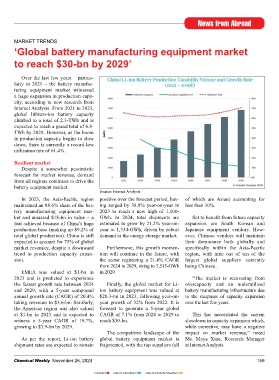

Over the last few years – particu-

larly in 2021 – the battery manufac-

turing equipment market witnessed

a huge expansion in production capa-

city, according to new research from

Interact Analysis. From 2021 to 2023,

global lithium-ion battery capacity

climbed to a total of 2.3-TWh and is

expected to reach a grand total of 6.8-

TWh by 2029. However, as the boom

in production capacity begins to slow

down, there is currently a record-low

utilisation rate of 61.4%.

Resilient market

Despite a somewhat pessimistic

forecast for market revenue, demand

from all regions continues to drive the

battery equipment market.

Source: Interact Analysis

In 2023, the Asia-Pacific region positive over the forecast period, hav- of which are Asian) accounting for

maintained an 88.6% share of the bat- ing surged by 38.8% year-on-year in less than 30%.

tery manufacturing equipment mar- 2023 to reach a new high of 1,100-

ket and amassed $18-bn in value – a GWh. In 2024, total shipments are Set to benefit from future capacity

feat achieved because of China’s huge estimated to grow by 21.2% year-on- expansion are South Korean and

production base (making up 89.2% of year to 1,334-GWh, driven by robust Japanese equipment vendors. How-

total global production). China is still demand in the energy storage market. ever, Chinese vendors will maintain

expected to account for 75% of global their dominance both globally and

market revenues, despite a downward Furthermore, this growth momen- specifically within the Asia-Pacific

trend in production capacity expan- tum will continue in the future, with region, with nine out of ten of the

sion. the sector registering a 21.4% CAGR largest global suppliers currently

from 2024 to 2029, rising to 3,515-GWh being Chinese.

EMEA was valued at $1-bn in in 2029.

2023 and is predicted to experience “The market is recovering from

the fastest growth rate between 2024 Finally, the global market for Li- overcapacity and an underutilised

and 2029, with a 5-year compound ion battery equipment was valued at battery manufacturing infrastructure due

annual growth rate (CAGR) of 20.4% $20.3-bn in 2023, following year-on- to the steepness of capacity expansion

taking revenues to $3.6-bn. Similarly, year growth of 32% from 2022. It is over the last few years.

the Americas region was also valued forecast to generate a 5-year global

at $1-bn in 2023 and is expected to CAGR of 7.1% from 2024 to 2029 to This has necessitated the current

witness a 5-year CAGR of 19.7%, reach $30-bn. slowdown in capacity expansion which,

growing to $3.9-bn by 2029. while corrective, may have a negative

The competitive landscape of the impact on market revenue,” noted

As per the report, Li-ion battery global battery equipment market is Ms. Maya Xiao, Research Manager

shipment rates are expected to remain fragmented, with the top suppliers (all at Interact Analysis.

Chemical Weekly November 26, 2024 159

Contents Index to Advertisers Index to Products Advertised