Page 132 - CW E-Magazine (21-11-2023)

P. 132

Point of View

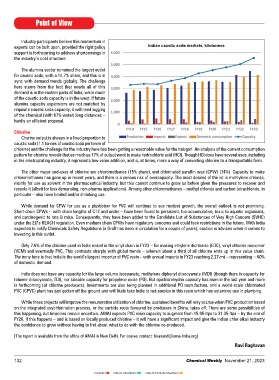

Industry participants believe this momentum in

exports can be built upon, provided the right policy Indian caustic soda markets, kilotonnes

support is forthcoming to address shortcomings in

the industry’s cost structure.

The alumina sector remained the largest outlet

for caustic soda, with a 14.7% share, and this is in

sync with demand trends globally. The challenge

here stems from the fact that nearly all of this

demand is in the eastern parts of India, while much

of the caustic soda capacity is in the west. If future

alumina capacity expansions are not matched by

requisite caustic soda capacity, it will need lugging

of the chemical (with 67% water) long distances –

hardly an efficient proposal.

Chlorine

Chorine output is always in a fixed proportion to

caustic soda (1.1 tonnes of caustic soda per tonne of

chlorine) and the challenge for the industry here has been getting a reasonable value for the halogen. An analysis of the current consumption

pattern for chlorine reveals that as much as 17% of output went to make hydrochloric acid (HCl). Though HCl does have several uses, including

in the electroplating industry, it represents low value addition, and is, at times, more a way of converting chlorine to a transportable form.

The other major end-uses of chlorine are chloromethanes (15% share), and chlorinated paraffin wax (CPW) (14%). Capacity to make

chloromethanes has gone up in recent years, and there is a serious risk of overcapacity. The most desired of the lot is methylene chloride,

mainly for use as solvent in the pharmaceutical industry, but this cannot continue to grow as before given the pressures to recover and

recycle it (albeit for less demanding, non-pharma applications). Among other chloromethanes – methyl chloride and carbon tetrachloride, in

particular – also have limited and/or shrinking use.

While demand for CPW for use as a plasticiser for PVC will continue to see modest growth, the overall outlook is not promising.

Short-chain CPWs – with chain lengths of C12 and under – have been found to persistent, bio-accumulative, toxic to aquatic organisms,

and carcinogenic to rats & mice. Consequently, they have been added to the Candidate List of Substances of Very High Concern (SVHC)

under the EU’s REACH regulation. Even medium chain CPWs have regulatory concerns and could face restrictions in the future. With India

expected to notify Chemicals Safety Regulations (a Draft has been in circulation for a couple of years), caution is advised when it comes to

investing in this outlet.

Only 7.6% of the chlorine used in India ended in the vinyl chain in FY23 – for making ethylene dichloride (EDC), vinyl chloride monomer

(VCM) and eventually PVC. This contrasts sharply with global trends – wherein about a third of all chlorine ends up in this value chain.

The irony here is that India is the world’s largest importer of PVC resin – with annual imports in FY23 reaching 2.27-mt – representing ~60%

of domestic demand.

India does not have any capacity for the large volume isocyanate, methylene diphenyl diisocyanate (MDI) (though there is capacity for

toluene diisocyanate, TDI), nor sizeable capacity for propylene oxide (PO). But epichlorohydrin capacity has risen in the last year and more

is forthcoming (at chlorine producers). Investments are also being planned in additional PO manufacture, and a world-scale chlorinated

PVC (CPVC) plant has just gotten off the ground and will likely take India to net-surplus in this resin which has extensive use in plumbing.

While these projects will improve the remunerative utilisation of chlorine, sustained benefits will only accrue when PVC production based

on the integrated oxychlorination process, or the carbide route favoured by producers in China, takes off. There are some possibilities of

this happening, but timelines remain uncertain. AMAI expects PVC resin capacity to augment from 15.95-ltpa to 31.35-ltpa – by the end of

FY26. If this happens – and is based on locally produced chlorine – it will have a significant impact and give the Indian chlor-alkali industry

the confidence to grow without having to fret about what to do with the chlorine co-produced.

[The report is available from the office of AMAI in New Delhi. For copies contact: hkanand@ama-india.org]

Ravi Raghavan

132 Chemical Weekly November 21, 2023

Contents Index to Advertisers Index to Products Advertised