Page 155 - CW E-Magazine (13-5-2025)

P. 155

News from Abroad

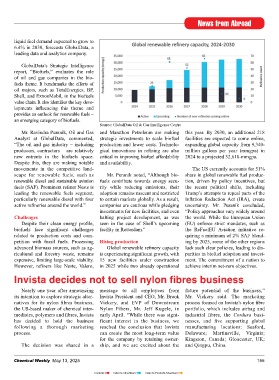

liquid fuel demand expected to grow to

6.4% in 2030, forecasts GlobalData, a

leading data and analytics company.

GlobalData’s Strategic Intelligence

report, “Biofuels,” evaluates the role

of oil and gas companies in the bio-

fuels theme. It benchmarks the efforts of

oil majors, such as TotalEnergies, BP,

Shell, and ExxonMobil, in the biofuels

value chain. It also identifies the key deve-

lopments influencing this theme and

provides an outlook for renewable fuels –

an emerging category of biofuels.

Source: GlobalData Oil & Gas Intelligence Centre

Mr. Ravindra Puranik, Oil and Gas and Marathon Petroleum are making this year. By 2030, an additional 218

Analyst at GlobalData, commented, strategic investments to scale biofuel facilities are expected to come online,

“The oil and gas industry – including production and lower costs. Technolo- expanding global capacity from 9,340-

producers, contractors – are relatively gical innovations in refining are also million gallons per year (mmgpa) in

new entrants in the biofuels space. critical in improving biofuel affordability 2024 to a projected 32,618-mmgpa.

Despite this, they are making notable and availability.

movements in the competitive land- The US currently accounts for 51%

scape for renewable fuels, such as Mr. Puranik noted, “Although bio- share in global renewable fuel produc-

renewable diesel and sustainable aviation fuels contribute towards energy secu- tion, driven by policy incentives, but

fuels (SAF). Prominent refiner Neste is rity while reducing emissions, their the recent political shifts, including

leading the renewable fuels segment, adoption remains nascent and restricted Trump’s attempts to repeal parts of the

particularly renewable diesel with four to certain markets globally. As a result, Inflation Reduction Act (IRA), create

active refineries around the world.” companies are cautious while pledging uncertainty. Mr. Puranik concluded,

investments for new facilities, and even “Policy approaches vary widely around

Challenges halting project development, as was the world. While the European Union

Despite their clean energy profile, seen in the case of Shell’s upcoming (EU) enforce strict mandates, such as

biofuels face significant challenges facility in Rotterdam.” the ReFuelEU Aviation initiative re-

related to production costs and com- quiring a minimum of 2% SAF blend-

petition with fossil fuels. Processing Rising production ing by 2025, some of the other regions

advanced biomass sources, such as ag- Global renewable refinery capacity lack such clear policies, leading to dis-

ricultural and forestry waste, remains is experiencing significant growth, with parities in biofuel adoption and invest-

expensive, limiting large-scale viability. 15 new facilities under construction ment. The commitment of a nation to

However, refiners like Neste, Valero, in 2025 while two already operational achieve interim net-zero objectives.

Invista decides not to sell nylon fibres business

Nearly one year after announcing message to all employees from future potential of the business,”

its intention to explore strategic alter- Invista President and CEO, Mr. Brook Mr. Vickery said. The marketing

natives for its nylon fibres business, Vickery, and EVP of Downstream process focused on Invista’s nylon fibre

the US-based maker of chemical inter- Nylon Fibers, Mr. Jeff Kugele, in portfolio, which includes airbag and

mediates, polymers and fibres, Invista early April. “While there was signi- industrial fibres, the Cordura busi-

has decided to hold the business ficant interest in the business, we nesses, and five supporting global

following a thorough marketing reached the conclusion that Invista manufacturing locations: Seaford,

process. can create the most long-term value Delaware; Martinsville, Virginia;

for the company by retaining owner- Kingston, Canada; Gloucester, UK;

The decision was shared in a ship, and we are excited about the and Qingpu, China.

Chemical Weekly May 13, 2025 155

Contents Index to Advertisers Index to Products Advertised