Page 132 - CW E-Magazine (19-3-2024)

P. 132

Point of View

3,000-bpd in 2022. The exports are restricted

to mainly three countries in Northwest Europe:

the UK, Sweden, and Belgium. Part of the reason

for the decline is that the high natural gas prices

in Europe are incentivising producers to retain

ethane in the natural gas stream and sell it to

energy markets at better economics than invest-

ing in separating it and selling as a petrochemical

feedstock. Industry watchers do not expect to

see this trend to reverse in Norway, also given

the dislike for extractive industries in the country.

The US presents a very different picture, and

is expected to continue to expand ethane production and exports. The ethane is extracted from natural gas liquid streams and

its production is highly flexible. Natural gas operators can increase ethane rejection (i.e., keep it in the gas), during periods of

low ethane prices, or increase extraction, when ethane prices are at a premium. As a result of this flexibility, stable domestic

demand and rising shale gas production, ethane production in the US is set to increase while prices are likely to remain stable.

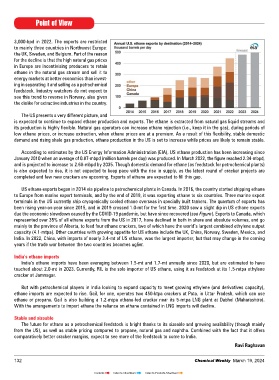

According to estimates by the US Energy Information Administration (EIA), US ethane production has been increasing since

January 2010 when an average of 0.87-mbpd (million barrels per day) was produced. In March 2022, the figure reached 2.34-mbpd,

and is projected to increase to 2.68-mbpd by 2035. Though domestic demand for ethane (as feedstock for petrochemical plants)

is also expected to rise, it is not expected to keep pace with the rise in supply, as the latest round of cracker projects are

completed and few new crackers are upcoming. Exports of ethane are expected to fill this gap.

US ethane exports began in 2014 via pipeline to petrochemical plants in Canada. In 2016, the country started shipping ethane

to Europe from marine export terminals, and by the end of 2018, it was exporting ethane to six countries. Three marine export

terminals in the US currently ship cryogenically cooled ethane overseas in specially built tankers. The quantum of exports has

been rising year-on-year since 2015, and in 2019 crossed 1.0-mt for the first time. 2020 saw a slight dip in US ethane exports

due the economic slowdown caused by the COVID-19 pandemic, but have since recovered (see Figure). Exports to Canada, which

represented over 35% of all ethane exports from the US in 2017, have declined in both in share and absolute volumes, and go

mainly to the province of Alberta, to feed four ethane crackers, two of which have the world’s largest combined ethylene output

capacity (4.1-mtpa). Other countries with growing appetite for US ethane include the UK, China, Norway, Sweden, Mexico, and

India. In 2022, China, with imports of nearly 3.4-mt of US ethane, was the largest importer, but that may change in the coming

years if the trade war between the two countries becomes uglier.

India’s ethane imports

India’s ethane imports have been averaging between 1.5-mt and 1.7-mt annually since 2020, but are estimated to have

touched about 2.0-mt in 2023. Currently, RIL is the sole importer of US ethane, using it as feedstock at its 1.5-mtpa ethylene

cracker at Jamnagar.

But with petrochemical players in India looking to expand capacity to meet growing ethylene (and derivatives capacity),

ethane imports are expected to rise. Gail, for one, operates two 450-ktpa crackers at Pata, in Uttar Pradesh, which can use

ethane or propane. Gail is also building a 1.2-mtpa ethane-fed cracker near its 5-mtpa LNG plant at Dabhol (Maharashtra).

With the arrangements to import ethane the reliance on ethane contained in LNG imports will decline.

Stable and sizeable

The future for ethane as a petrochemical feedstock is bright thanks to its sizeable and growing availability (though mainly

from the US), as well as stable pricing compared to propane, natural gas and naphtha. Combined with the fact that it offers

comparatively better cracker margins, expect to see more of the feedstock to come to India.

Ravi Raghavan

132 Chemical Weekly March 19, 2024

Contents Index to Advertisers Index to Products Advertised