Page 169 - CW E-Magazine (24-6-2025)

P. 169

Special Article 4 – 24.06.2025

6,000

5,000 4,242 4,712 5,089 5,496

1,410

3,897

4,000

2,973 3,378

3,000 2,735 3,091

Special Report 2,326 Special Report

2,000 1,475 Special Article 4 – 24.06.2025

4,086

1,000 1,498 1,571 1,507 1,621 1,711

PVC industry: Import dependency set to halve sion of surplus production to the Indian 6,000 5,089 5,496

0

market. This put sustained pressure on

FY26

below 30% by FY27 PVC prices, which declined by 24% 5,000 FY22 FY23 3,897 FY24 4,242 FY25 4,712 FY27 1,410

from $1,026 per tonne in FY23 to $782

SYNOPSIS become effective from end-June 2025 CareEdge Ratings per tonne in FY25, resulting in a similar 4,000 Domestic production Imports Apparent demand

2,973

emand for polyvinyl chloride and likely imposition of anti-dumping moderation in PVC-EDC spread, impact- Fig. 1: PVC supply-demand, kilotonnes 3,091 3,378

3,000

2,735

2,326

(PVC) resin in India has wit- duty on Suspension PVC resin imports, Signifi cant domestic capacity ing the profi tability of PVC players. Source: Company Annual Reports/Presentations, Chemicals & Petrochemicals Manufacturers’ Association

1,475

Dnessed healthy growth at a subject to fi nal fi ndings of the DGTR, planned to cut import dependency PVC-EDC spread expected to improve from H2FY26 4,086

2,000

CAGR of 6.2% during FY20-FY25, the PVC-EDC spread is expected to Considering the robust and sustain- Tariff and non-tariff measures In the immediate aftermath of the COVID-19 pandemic, domestic PVC prices and PVC-EDC spread improved in FY21

1,000

reaching 4.7-mt during FY25, on the improve to ~$500 per tonne in H2FY26, able demand for PVC resin witnessed During February 2024, the Depart- and FY22 due to supply-side challenges. Thereafter, PVC prices corrected significantly downward in FY23 with supply

1,711

1,571

1,621

1,507

1,498

returning to normalcy, which was simultaneously accompanied by a slowdown in global demand. During FY24-FY25,

back of strong demand from end-user thereby helping Indian PVC players. in the last few years, large-scale manu- ment of Chemicals and Petrochemicals amidst challenging global macroeconomic conditions, international demand for PVC remained subdued, leading to an

0

industries supported by favourable facturing capacities are in the offi ng. In issued a Quality Control Order making a oversupply in the global market. This surplus was redirected to countries like India, where demand for PVC was strong.

government policies. PVC demand is Strong domestic PVC demand; consump- all, incremental PVC resin manufactur- Bureau of Indian Standards (BIS) certifi - FY22 FY23 FY24 FY25 FY26 FY27

expected to grow by ~8% per annum to tion Projected at ~5.5-mt by FY27 ing capacity of ~2.5-mtpa is expected to cate mandatory for PVC imports, which is Due to excess capacity and weak demand in China, India has witnessed sizeable dumping of PVC from China during

Imports

Apparent demand

reach ~5.5-mt by FY27. Out of India’s PVC resin (suspension & paste) pri- come on stream by FY27. With that, Care expected to become effective from June 24, the last few years. Imports from China, which accounted for only ~3% of total PVC imports in India during FY20,

Domestic production

rapidly increased to ~40% in FY25. Also, weak demand in the USA led to diversion of surplus production to the Indian

total demand for PVC, ~95% pertains marily fi nds application in end-use sec- Edge Ratings expects India’s import 2025, after a few postponements. Also, market. This put sustained pressure on PVC prices, which declined by 24% from $1,026 per tonne in FY23 to $782 per

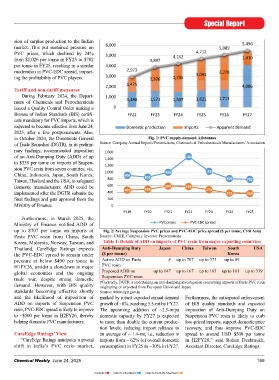

Fig. 1: PVC supply-demand, kilotonnes

to Suspension PVC resin, and the tors such as irrigation systems (pipes), dependency for PVC resin to decline in October 2024, the Directorate General Fig. 1: PVC supply-demand, kilotonnes

tonne in FY25, resulting in a similar moderation in PVC-EDC spread, impacting the profitability of PVC players.

Source: Company Annual Reports/Presentations, Chemicals & Petrochemicals Manufacturers’ Association

balance ~5% pertains to Paste PVC resin. real estate (plumbing and building mate- from ~3-mt in FY25 to ~1.4-mt in FY27. of Trade Remedies (DGTR), in its prelimi- Source: Company Annual Reports/Presentations, Chemicals & Petrochemicals Manufacturers’ Association

rials), infrastructure (water supply and However, sizeable import dependency is nary fi ndings, recommended imposition 1,600

1,464

Due to stagnant domestic manufac- sanitation) and automotive. PVC resin expected to continue in the foreseeable of an Anti-Dumping Duty (ADD) of up PVC-EDC spread expected to improve from H2FY26

1,400

In the immediate aftermath of the COVID-19 pandemic, domestic PVC prices and PVC-EDC spread improved in FY21

turing capacity at ~1.8-mtpa over the is mainly used in the manufacturing of future due to the non-availability of an to $339 per tonne on imports of Suspen- and FY22 due to supply-side challenges. Thereafter, PVC prices corrected significantly downward in FY23 with supply

1,200

past few years, the demand-supply gap products such as pipes & fi ttings (~80% adequate and reliable supply of the key sion PVC resin from seven countries, viz. returning to normalcy, which was simultaneously accompanied by a slowdown in global demand. During FY24-FY25,

1,026

1,000

996

906

has widened from ~1.5-mt in FY22 to demand) and wires & cables (~7%) raw material, i.e., EDC, which could China, Indonesia, Japan, South Korea, amidst challenging global macroeconomic conditions, international demand for PVC remained subdued, leading to an

852

809

800

782

~3-mt in FY25, which has been catered amongst others, which are mainly used restrict further large capacity additions. Taiwan, Thailand and the USA, to safeguard oversupply in the global market. This surplus was redirected to countries like India, where demand for PVC was strong.

600

through a steady increase in imports, in the above-mentioned end-use sectors. domestic manufacturers. ADD could be 465 488 584 569 474

400

373

359

which constituted ~62% of total domes- PVC-EDC spread expected to implemented after the DGTR submits the Due to excess capacity and weak demand in China, India has witnessed sizeable dumping of PVC from China during

200

tic PVC consumption in FY25. These Demand for PVC resin has wit- improve from H2FY26 fi nal fi ndings and gets approval from the the last few years. Imports from China, which accounted for only ~3% of total PVC imports in India during FY20,

0

imports have primarily come from nessed healthy growth at a CAGR of In the immediate aftermath of the Ministry of Finance. rapidly increased to ~40% in FY25. Also, weak demand in the USA led to diversion of surplus production to the Indian

China, Japan, Taiwan, South Korea and 6.2% during FY20-FY25. PVC resin COVID-19 pandemic, domestic PVC prices market. This put sustained pressure on PVC prices, which declined by 24% from $1,026 per tonne in FY23 to $782 per

FY23

FY22

FY24

FY21

FY25

FY19

FY20

the USA. New PVC resin manufactur- demand increased to 4.7-mt during and PVC-EDC spread improved in FY21 Furthermore, in March 2025, the tonne in FY25, resulting in a similar moderation in PVC-EDC spread, impacting the profitability of PVC players.

ing capacity of ~2.5-mtpa is expected FY25, with ~11% y-o-y growth, on the and FY22 due to supply-side challenges. Ministry of Finance notifi ed ADD of PVC prices PVC-EDC spread

to gradually come on stream in India by back of strong demand from end-user Thereafter, PVC prices corrected signi- up to $707 per tonne on imports of Fig. 2: Average Suspension PVC prices and PVC-EDC price spread ($ per tonne, CFR Asia)

Fig. 2: Average Suspension PVC prices and PVC-EDC price spread ($ per tonne, CFR Asia)

1,600

FY27, which is envisaged to reduce our sectors supported by favourable govern- fi cantly downward in FY23 with supply Paste PVC resin from China, South Source: CMIE, Company Investor Presentations 1,464

Source: CMIE, Company Investor Presentations

Table 1: Details of ADD on imports of PVC resin from major exporting countries:

1,400

import dependency from ~3-mt in FY25 ment policies such as Pradhan Mantri returning to normalcy, which was simul- Korea, Malaysia, Norway, Taiwan, and Tariff and non-tariff measures

Anti-Dumping Duty

USA

South

Taiwan

China

Japan

to an average of ~1.4-mt in FY27. Sur- Awas Yojana, Jal Jeevan Mission, taneously accompanied by a slowdown Thailand. CareEdge Ratings expects During February 2024, the Department of Chemicals and Petrochemicals issued a Quality Control Order making a

1,200

Korea

($ per tonne)

plus capacity and weak demand in major etc. Going forward as well, CareEdge in global demand. During FY24-FY25, the PVC-EDC spread to remain under Bureau of Indian Standards (BIS) certificate mandatory for PVC imports, which is expected to become effective from

1,026

1,000

996

Active ADD on Paste

#

global economies resulted in substantial Ratings expects PVC demand momen- amidst challenging global macroeco- pressure at below $400 per tonne in June 24, 2025, after a few postponements. up to 707 up to 373 up to 89 –

906

852

PVC resin

809

800

782

dumping of cheaper PVC in India during tum to continue with expected growth nomic conditions, international demand H1FY26, amidst a slowdown in major Also, in October 2024, the Directorate General of Trade Remedies (DGTR), in its preliminary findings, recommended

Proposed ADD on

up to 167

up to 147

the last few years, which put pressure on of ~8% per annum to reach 5.5-mt by for PVC remained subdued, leading to global economies and the ongoing imposition of an Anti-Dumping Duty (ADD) of u up to 163 up to 161 up to 339

600

584p to $339 per tonne on imports of Suspension PVC resin from seven

569

Suspension PVC resin

488

domestic PVC prices and led to modera- FY27 on the back of strong demand an oversupply in the global market. This trade war, despite strong domestic countries, viz. China, Indonesia, Japan, South Korea, Taiwan, Thailand and the USA, to safeguard domestic

474

465

400

#Currently, DGTR is undertaking an anti-dumping investigation concerning imports of Paste PVC resin

373

359

tion of the PVC-EDC (Ethylene Dichlo- from end-user sectors, considering the surplus was redirected to countries like demand. However, with BIS quality manufacturers. ADD could be implemented after the DGTR submits the final findings and gets approval from the

originating or exported from European Union and Japan.

200

ride) spread, impacting the profi tability existing low per capita consumption of India, where demand for PVC was strong. standards becoming effective shortly Ministry of Finance.

Source: www.dgtr.gov.in

of India’s PVC players. PVC. On the back of strong demand and the likelihood of imposition of marked by robust expected annual demand Furthermore, the anticipated enforcement 2

0

growth coupled with stagnant domestic Due to excess capacity and weak ADD on imports of Suspension PVC growth of ~8%, reaching 5.5-mt by FY27. of BIS quality standards and expected FY25

FY24

FY23

FY22

FY21

FY20

FY19

Going forward, PVC-EDC spread manufacturing capacity at ~1.8-mtpa demand in China, India has witnessed resin, PVC-EDC spread is likely to improve The upcoming addition of ~2.5-mtpa imposition of Anti-Dumping Duty on

is expected to remain under pressure over past few years, the demand-supply sizeable dumping of PVC from China to ~$500 per tonne in H2FY26, thereby domestic capacity by FY27 is expected Suspension PVC resin is likely to curb

PVC prices

PVC-EDC spread

at below $400 per tonne in H1FY26 gap for PVC resin widened from ~1.5-mt during the last few years. Imports from helping domestic PVC manufacturers. to more than double the current produc- low-priced imports, support domestic price

amidst continued demand slowdown in FY22 to ~3-mt in FY25 which has China, which accounted for only ~3% of tion levels, reducing import reliance to recovery, and thus improve PVC-EDC

Fig. 2: Average Suspension PVC prices and PVC-EDC price spread ($ per tonne, CFR Asia)

in major economies and ongoing trade been catered through steady increase in total PVC imports in India during FY20, CareEdge Ratings’ View an average of ~ 1.4-mt, i.e., reduction in spread to around USD $500 per tonne

Source: CMIE, Company Investor Presentations

war. However, with BIS Quality Stan- imports primarily from China, Japan, rapidly increased to ~40% in FY25. Also, “CareEdge Ratings anticipates a pivotal imports from ~ 62% (of overall domestic in H2FY26,” said Rohan Deshmukh,

Tariff and non-tariff measures

dards for import of PVC resin slated to Taiwan, South Korea and the USA. weak demand in the USA led to diver- shift in India’s PVC resin market, consumption) in FY25 to ~30% in FY27. Assistant Director, CareEdge Ratings.

During February 2024, the Department of Chemicals and Petrochemicals issued a Quality Control Order making a

Bureau of Indian Standards (BIS) certificate mandatory for PVC imports, which is expected to become effective from

168 Chemical Weekly June 24, 2025 Chemical Weekly June 24, 2025 June 24, 2025, after a few postponements. 169

Also, in October 2024, the Directorate General of Trade Remedies (DGTR), in its preliminary findings, recommended

Contents Index to Advertisers Index to Products Advertised

imposition of an Anti-Dumping Duty (ADD) of up to $339 per tonne on imports of Suspension PVC resin from seven

countries, viz. China, Indonesia, Japan, South Korea, Taiwan, Thailand and the USA, to safeguard domestic

manufacturers. ADD could be implemented after the DGTR submits the final findings and gets approval from the

Ministry of Finance.

2