Page 131 - CW E-Magazine (30-7-2024)

P. 131

Point of View

Singapore’s chemical industry looks to reinvent itself

in the wake of business and sustainability challenges

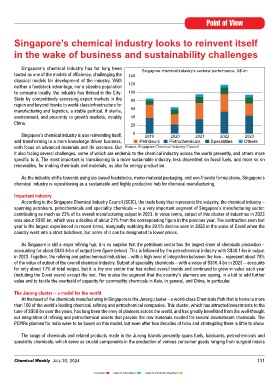

Singapore’s chemical industry has for long been Singapore chemical industry’s sectoral performance, S$-bn

touted as one of the models of efficiency, challenging the 140

classical models for development of the industry. With

neither a feedstock advantage, nor a sizeable population 120

to consume locally, the industry has thrived in the City- 100

State by competitively accessing export markets in the 80

region and beyond thanks to world-class infrastructure for

manufacturing and logistics, a stable political, if sterile, 60

environment, and proximity to growth markets, notably 40

China. 20

Singapore’s chemical industry is also reinventing itself, 0 2019 2020 2021 2022 2023

and transforming to a more knowledge-driven business, Petroleum Petrochemicals Specialties Others

with focus on advanced materials and life sciences. But Source: Singapore Chemical Industry Council

it also facing several challenges, some of which are endemic to the chemical industry across the world presently, and others more

specific to it. The most important is transitioning to a more sustainable industry, less dependent on fossil fuels, and more so on

renewables, for making chemicals and materials, as also for energy production.

As the industry shifts towards using bio-based feedstocks, mono-material packaging, and eco-friendly formulations, Singapore’s

chemical industry is repositioning as a sustainable and highly productive hub for chemical manufacturing.

Important industry

According to the Singapore Chemical Industry Council (SCIC), the trade body that represents the industry, the chemical industry –

spanning petroleum, petrochemicals and speciality chemicals – is a very important segment of Singapore’s manufacturing sector,

contributing as much as 23% of its overall manufacturing output in 2023. In value terms, output of this cluster of industries in 2023

was about S$95-bn, which was a decline of about 21% from the corresponding figure in the previous year. The contraction seen last

year is the largest experienced in recent times, marginally outdoing the 20.5% decline seen in 2020 in the wake of Covid when the

country went into a strict lockdown, but some of it can be designated to lower prices.

As Singapore is still a major refining hub, it is no surprise that the petroleum sector has the largest share of chemicals production –

accounting for about S$43.6-bn of output (see figure below). This is followed by the petrochemical industry with S$30.1-bn in output

in 2023. Together, the refining and petrochemical industries – with a high level of integration between the two – represent about 78%

of the value of output of the overall chemical industry. Output of speciality chemicals – with a value of S$16.4-bn in 2023 – accounts

for only about 17% of total output, but it is the one sector that has defied overall trends and continued to grow in value each year

(including the Covid years) except the last. This is also the segment that the country’s planners are eyeing, in a bid to add further

value and to tackle the overbuild of capacity for commodity chemicals in Asia, in general, and China, in particular.

The Jurong cluster – a model for the world

At the heart of the chemicals manufacturing in Singapore is the Jurong cluster – a world-class Chemicals Park that is home to more

than 100 of the world’s leading chemical, refining and petrochemical companies. This cluster, which has attracted investments to the

tune of S$50-bn over the years, has long been the envy of planners across the world, and has greatly benefitted from the well-thought

out integration of refining and petrochemical assets that provide the raw materials needed for several downstream chemicals. The

PCPIRs planned for India were to be based on this model, but even after two decades of talks and strategizing there is little to show.

The range of chemicals and related products made in the Jurong Islands presently spans fuels, lubricants, petrochemicals and

speciality chemicals, which serve as crucial components in the production of various consumer goods ranging from surgical masks

Chemical Weekly July 30, 2024 131

Contents Index to Advertisers Index to Products Advertised