Page 181 - CW E-Magazine (18-2-2025)

P. 181

Special Report Special Report

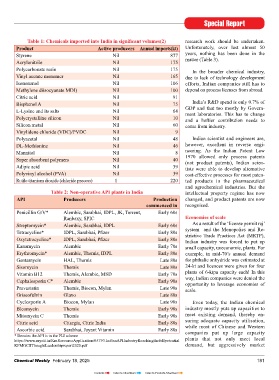

High cost of chemicals manufacturing in India: Table 1: Chemicals imported into India in signifi cant volumes(2) research work should be undertaken.

Product Active producers Annual imports(kt) Unfortunately, over last almost 50

Reasons and remedies Styrene Nil 877 years, nothing has been done in the

matter (Table 3).

Acrylonitrile Nil 175

$1 trillion chemical industry by 2040 $60-bn contribution from the ferti- Y.H. GHARPURE Polycarbonate resin Nil 175 In the broader chemical industry,

challenge(1) liser sector. Email: gharpure03@gmail.com Vinyl acetate monomer Nil 165 due to lack of technology development

report prepared by McKin- Isononanol Nil 106 efforts, Indian companies still has to

sey & Company, a consul- Currently, India is net importer industry (about Rs.150,000-crore), Methylene diisocyanate MDI) Nil 100 depend on process licenses from abroad.

A tancy, in 2023 talks of Indian of chemicals, with adverse trade leading to ‘tax on tax’. Citric acid Nil 91

chemical industry reaching a size of balance of $15-bn spread across all Bisphenol A Nil 75 India’s R&D spend is only 0.7% of

$850-bn to $1,000-bn by 2040. The major sectors like petrochemicals, Likewise, electricity generation, GDP and that too mostly by Govern-

current size of the Indian market is speciality, organic, and inorganic transmission, and distribution is also L-Lysine and its salts Nil 64 ment laboratories. This has to change

about $250-bn. It means that produc- chemicals, etc. The McKinsey re- outside the ambit of GST, and the Polycrystalline silicon Nil 10 and a heftier contribution needs to

tion in 2023 will need to quadruple port also highlights India’s petro- total levy collected from the sector Silicon metal Nil 60 come from industry.

in next 16 years. This projection is chemical imports, which is expec- is about Rs. 50,000-crore. Vinylidene chloride (VDC)/PVDC Nil 9

based on total domestic consumption ted to rise to $101-bn by 2040, as Polyacetal Nil 48 Indian scientist and engineers are,

plus exports and would require against export of $60-bn, leaving a This has cost consequences for DL-Methionine Nil 46 however, excellent in reverse engi-

approximately 7% growth rate per trade gap of ~$40-bn from this sub- energy-intensive chemical manufactur- Mannitol Nil 8 neering. As the Indian Patent Law

annum. sector alone. An analysis of India’s ing units, in particular. Fermentation 1970 allowed only process patents

chemical imports in FY22 reveals processes, for example, require Super absorbent polymers Nil 40 (not product patents), Indian scien-

If you remove out of this $1,000-bn that 44% of all imports came from energy for agitation, areation and stera- Adipic acid Nil 39 tists were able to develop alternative

projection products like pharma China. Indian industry will have to fi nd lisation. Its is no surprise therefore Polyvinyl alcohol (PVA) Nil 39 cost-effective processes for most paten-

(vaccines, injectables, medical devi- cost-effective solutions to the problems that a large number of fermentation Rutile titanium dioxide (chloride process) 1 220 ted products in the pharmaceutical

ces, etc.) and personal care con- impeding investiments so as to be cost- facilities have closed down in India, and agrochemical industries. But the

sumer products (shampoo, hair oils, competitive, particularly against China, in part due to high cost of solvents Table 2: Non-operative API plants in India intellectual property regime has now

toothpastes, soaps, etc), the chemi- and so bridge the trade defi cit. and energy (Table 2): API Producers Production changed, and product patents are now

cal production would only be 20% or commenced in recognised.

thereabout. Actual chemical demand In this paper, we will try to ana- Furthermore, power cuts are en- Penicillin G/V* Alembic, Sarabhai, IDPL, JK, Torrent, Early 60s

will then be reduced to $650-bn to lyse the reasons for high cost of manu- demic in India, adversely impacting Ranbaxy, SPIC Economies of scale

$760-bn, which includes a $50-bn to facturing of chemicals in India and the operations of continuous chemical Streptomycin* Alembic, Sarabhai, IDPL Early 60s As a result of the ‘license permit raj’

possible remedies to plants, in particular. system and the Monopolies and Re-

Others overcome the same. Tetracycline* IDPL, Sarabhai, Pfi zer Early 80s strictive Trade Practices Act (MRTP),

19% Oxytetracycline* IDPL, Sarabhai, Pfi zer Early 80s

Malaysia As against above, China aggres- Indian industry was forced to put up

Germany 3%

2% High raw material sively supports its chemical industry Kanamycin Alembic Early 70s small capacity, uneconomic, plants. For

Qatar and energy costs (Table 2)(3): Erythromycin* Alembic, Themis, IDPL Early 80s example, in mid-70’s annual demand

3% Raw material costs for phthalic anhydride was estimated at

Taiwan Gentamycin HAL, Themis Late 80s

3% are high because the Improving process effi ciency Sisomycin Themis Late 80s 24-kt and licences were given for four

Japan Goods and Services Lack of improvement in process plants of 6-ktpa capacity each! In this

3% Tax (GST) regime is efficiencies, through innovation, re- Vitamin B12 Themis, Alembic, MSD Early 70s way, Indian companies were denied the

South Cephalosporin C* Alembic Early 90s

Korea not comprehensive. fl ected in the low spend on Research & opportunity to leverage economies of

5% Development (R&D), is also res- Pravastatin Themis, Biocon, Mylan Late 90s scale.

Saudi Petroleum products ponsible for high cost of produc- Griseofulvin Glaxo Late 80s

Arabia China like crude oil, natural tion. Cyclosporin A Biocon, Mylan Late 90s Even today, the Indian chemical

6% 44%

gas, petrol, diesel, and Bleomycin Themis Early 90s industry mostly puts up capacities to

Singapore aviation turbine fuel In the fermentation industry, for Mitomycin C Themis Early 90s meet existing demand, thereby en-

5% (ATF) are outside the instance, strain development is very suring adequate capacity utilisation,

USA Citric acid Citurgia, Citric India Early 80s

7% purview of GST. As a important and this was emphasised way Ascorbic acid Sarabhai, Jayant Vitamin Early 80s while most of Chinese and Western

result there is no Input back in 1975 by the Hathi Committee companies put up large capacity

Fig. 1: India’s imports of organic chemicals by country * Denotes the API is in the PLI scheme

of origin ($28.5-bn, FY21) Tax Credit (ITC) available for Report where it was recommended https://www.mycii.in/KmResourceApplication/65793.IndianAPIIndustryReachingthefullpotential plants that not only meet local

Source: International Trade Profi le of India tax paid on these inputs by that poste-haste, strain optimization KPMGCIIThoughtLeadershipreport2020.pdf demand, but aggressively market

180 Chemical Weekly February 18, 2025 Chemical Weekly February 18, 2025 181

Contents Index to Advertisers Index to Products Advertised