Page 130 - CW E-Magazine (10-12-2024)

P. 130

Point of View

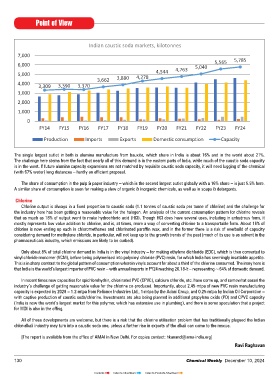

Indian caustic soda markets, kilotonnes

7,000 5,785

6,000 5,040 5,565

5,000 4,544 4,763

3,662 3,880 4,278

4,000

3,309 3,390 3,370

3,000

2,000

1,000

0

FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24

Production Imports Exports Domestic consumption Capacity

The single largest outlet in both is alumina manufacture from bauxite, which share in India is about 16% and in the world about 21%.

The challenge here stems from the fact that nearly all of this demand is in the eastern parts of India, while much of the caustic soda capacity

is in the west. If future alumina capacity expansions are not matched by requisite caustic soda capacity, it will need lugging of the chemical

(with 67% water) long distances – hardly an efficient proposal.

The share of consumption in the pulp & paper industry – which is the second largest outlet globally with a 16% share – is just 5.5% here.

A similar share of consumption is seen for making a slew of organic & inorganic chemicals, as well as in soaps & detergents.

Chlorine

Chlorine output is always in a fixed proportion to caustic soda (1.1 tonnes of caustic soda per tonne of chlorine) and the challenge for

the industry here has been getting a reasonable value for the halogen. An analysis of the current consumption pattern for chlorine reveals

that as much as 18% of output went to make hydrochloric acid (HCl). Though HCl does have several uses, including in anhydrous form, it

mostly represents low value addition to chlorine, and is, at times, more a way of converting chlorine to a transportable form. About 16% of

chlorine is now ending up each in chloromethanes and chlorinated paraffin wax, and in the former there is a risk of overbuild of capacity

considering demand for methylene chloride, in particular, will not keep up to the growth trends of the past (much of its use is as solvent in the

pharmaceuticals industry, which emissions are likely to be curbed).

Only about 8% of total chlorine demand in India is in the vinyl industry – for making ethylene dichloride (EDC), which is then converted to

vinyl chloride monomer (VCM), before being polymerised into polyvinyl chloride (PVC) resin, for which India has seemingly insatiable appetite.

This is in sharp contrast to the global pattern of consumption wherein vinyls account for about a third of the chlorine consumed. The irony here is

that India is the world’s largest importer of PVC resin – with annual imports in FY24 reaching 26.18-lt – representing ~64% of domestic demand.

In recent times new capacities for epichlorohydrin, chlorinated PVC (CPVC), calcium chloride, etc. have come up, and somewhat eased the

industry’s challenge of getting reasonable value for the chlorine co-produced. Importantly, about 2.45-mtpa of new PVC resin manufacturing

capacity is expected by 2028 – 1.2-mtpa from Reliance Industries Ltd., 1-mtpa by the Adani Group, and 0.25-mtpa by Indian Oil Corporation –

with captive production of caustic soda/chlorine. Investments are also being planned in additional propylene oxide (PO) and CPVC capacity

(India is now the world’s largest market for this polymer, which has extensive use in plumbing), and there is some speculation that a project

for MDI is also in the offing.

All of these developments are welcome, but there is a risk that the chlorine utilisation problem that has traditionally plagued the Indian

chlor-alkali industry may turn into a caustic soda one, unless a further rise in exports of the alkali can come to the rescue.

[The report is available from the office of AMAI in New Delhi. For copies contact: hkanand@ama-india.org]

Ravi Raghavan

130 Chemical Weekly December 10, 2024

Contents Index to Advertisers Index to Products Advertised