Page 134 - CW E-Magazine (5-12-2023)

P. 134

Top Stories

MARKET TRENDS

Hydrogen peroxide market to stay long despite

changes in trade fl ows

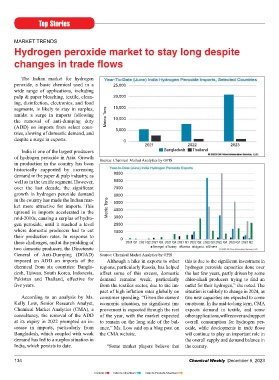

The Indian market for hydrogen

peroxide, a basic chemical used in a 25,000

wide range of applications, including

pulp & paper bleaching, textile, clean- 20,000

ing, disinfection, electronics, and food

segments, is likely to stay in surplus, 15,000

amidst a surge in imports following Metric Tons

the removal of anti-dumping duty 10,000

(ADD) on imports from select coun- 5,000

tries, slowing of domestic demand, and

despite a surge in exports. 0

2021 2022 2023

India is one of the largest producers Bangladesh Thailand

of hydrogen peroxide in Asia. Growth Source: Chemical Market Analytics by OPIS

in production in the country has been

historically supported by increasing

demand in the paper & pulp industry, as 9000

well as in the textile segment. However, 8000

over the last decade, the signifi cant 7000

growth in hydrogen peroxide demand 6000

in the country has made the Indian mar- 5000

ket more attractive for imports. This Metric Tons

uptrend in imports accelerated in the 4000

mid-2010s, causing a surplus of hydro- 3000

gen peroxide, until it reached a level 2000

where domestic producers had to cut 1000

their production rates. In response to 0

these challenges, and at the prodding of 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2

two domestic producers, the Directorate Senegal Turkey Russia Nigeria Ghana

General of Anti-Dumping (DGAD) Source: Chemical Market Analytics by OPIS

imposed an ADD on imports of the Although a hike in exports to other this is due to the signifi cant investment in

chemical from six countries: Bangla- regions, particularly Russia, has helped hydrogen peroxide capacities done over

desh, Taiwan, South Korea, Indonesia, offset some of this excess, domestic the last few years, partly driven by some

Pakistan and Thailand, effective for demand remains weak, particularly chlor-alkali producers trying to fi nd an

fi ve years. from the textiles sector, due to the im- outlet for their hydrogen,” she noted. The

pact of high infl ation rates globally on situation is unlikely to change in 2024, as

According to an analysis by Ms. consumer spending. “Given the current two new capacities are expected to come

Kelly Low, Senior Research Analyst, economic situation, no signifi cant im- on-stream. In the mid-to-long term, CMA

Chemical Market Analytics (CMA), a provement is expected through the rest expects demand in textile, and some

consultancy, the removal of the ADD of the year, with the market expected other applications, will recover and support

at its expiry in 2022 prompted an in- to remain on the long side of the bal- overall consumption for hydrogen per-

crease in imports, particularly from ance,” Ms. Low said on a blog post on oxide, while developments in trade fl ows

Bangladesh, which coupled with weak the CMA website. will continue to play an important role in

demand has led to a surplus situation in the overall supply and demand balance in

India, which persists to date. “Some market players believe that the country.

134 Chemical Weekly December 5, 2023

Contents Index to Advertisers Index to Products Advertised