Page 167 - CW E-Magazine (23-4-2024)

P. 167

Special Report Special Report

Overall, while there’s progress

India gradually moving towards alternative fuel in building infrastructure for eco-

vehicles friendly fuels, significant challenges

LPG remain. Overcoming these hurdles

Synopsis India’s auto revolution underway RANJAN SHARMA will be crucial for accelerating the

emand for vehicles powered The Indian automotive market, Senior Director adoption of these cleaner alter-

by traditional fuels such as based on fuel type, is undergoing a fasci- Email: Ranjan.Sharma@careedge.in EV natives and achieving India’s sustain-

Dpetrol and diesel is progres- nating revolution as India grapples ability goals.

sively shifting towards those that with rising air pollution and its commit- PULKIT AGARWAL CNG

utilise alternative fuels. The share of ment to reducing greenhouse gas emis- Director Total cost of ownership

petrol vehicle sales, as a percentage of sions. The need for cleaner and more Email: pulkit.agarwal@careedge.in When assessing the total cost of

total vehicle sales (includes Passenger sustainable transportation solutions Petrol & Diesel ownership (TCO) for vehicles powered

Vehicles, Commercial Vehicles, two has become increasingly crucial. While ARTI ROY by various fuels, including petrol,

and three-wheelers), has recorded a petrol and diesel have dominated the Associate Director 0 20,000 40,000 60,000 80,000 100,000 diesel, CNG/LPG, and EVs, it is

signifi cant decline, decreasing from Indian automotive scene for decades, Email: arti.roy@careedge.in crucial to consider not only the initial

86% in 2020 to 76% in 2023, while a wave of alternative fuel options is CareEdge Ratings purchase price, but also fuel expenses,

for diesel vehicles it has slightly emerging, offering both environmental Fig. 2: Fuelling stations in India maintenance costs, insurance premiums,

decreased from 12% in 2020 to 11% and economic benefi ts. CNG, LPG, EV and Hybrids (includ- Source: data.gov.in and CareEdge Ratings. and any applicable government

in 2023. ing Petrol/Diesel with CNG/LPG/ used in public transport, taxis, and than petrol and diesel pumps. This incentives or subsidies. According to

In recent years, there has been a Hybrids) with the major driver being EV. some private vehicles. limits the range and convenience of the analysis (see Table 1), EVs cur-

Electric vehicles (EVs), compressed notable shift towards exploring alter- The sales volume of these alternative using CNG vehicles. To encourage rently present the lowest TCO, with

natural gas (CNG), liquifi ed petroleum native fuel options that are both eco- fuel-driven vehicles recorded a growth LPG was used in some passenger the growth of charging/fuel stations/ CNG vehicles following closely

gas (LPG) and hybrids are gaining friendly and economically viable as of more than 400% in CY2023, as com- vehicles as an alternative fuel, but its pumps, the Indian government has behind.

popularity; however, the inadequacy seen from Figure 1 where the share pared to CY2020, albeit on a much adoption was not as widespread as launched several schemes to incenti-

of charging/fuelling infrastructure remains of traditional fuel-based vehicle sales smaller base. petrol and diesel because of inadequate vize the development of alternative While EVs have a higher upfront

a significant barrier, despite some volume is changing. fuelling stations. fuel infrastructure, such as subsidies cost, their lower fuel and mainte-

advancements. The decision to choose amongst and grants. nance expenses, coupled with gov-

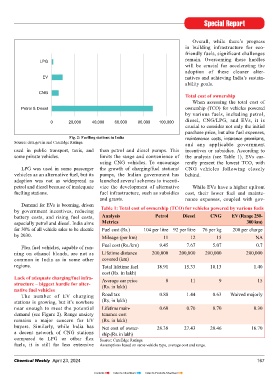

The share of petrol vehicles sold various alternatives such as EVs, Demand for EVs is booming, driven Table 1: Total cost of ownership (TCO) for vehicles powered by various fuels

At present, EVs offer the lowest in overall vehicle sales witnessed a CNG, LPG, petrol, diesel, or fl ex fuel by government incentives, reducing

lifetime cost, followed by CNG. substantial dip of around 10% during depends on various factors, driving battery costs, and rising fuel costs, Analysis Petrol Diesel CNG EV (Range 250-

CY2023 compared to just three years habits, and development of fuelling especially petrol and diesel. India aims Metrics 300 km)

The future of India’s mixed-fuel back in CY2020. Diesel vehicles, how- infrastructure. for 30% of all vehicle sales to be electric Fuel cost (Rs.) 104 per litre 92 per litre 76 per kg 200 per charge

automotive market will be determined ever, experienced a gradual shift, with by 2030. Mileage (per km) 11 12 15 NA

by government policies, infrastructure their market share decreasing margi- Navigating the choice: Driving factors Fuel cost (Rs./km) 9.45 7.67 5.07 0.7

development, and consumer prefe- nally from 12% in CY2020 to 11% in Petrol-powered vehicles have tradi- Flex fuel vehicles, capable of run-

rences. CY2023. The shift has been towards tionally led the passenger car segment ning on ethanol blends, are not as Lifetime distance 200,000 200,000 200,000 200,000

in India, favoured for their lower ini- common in India as in some other covered (km)

100.0% 7.0% tial costs and the extensive availabi- regions. Total lifetime fuel 18.91 15.33 10.13 1.40

6.0% lity of petrol. Diesel-powered vehicles cost (Rs. in lakh)

80.0%

5.0% are popular for their fuel effi ciency, Lack of adequate charging/fuel infra- Average car price 8 11 9 15

60.0% 4.0% especially in SUVs and commercial structure – biggest hurdle for alter- (Rs. in lakh)

40.0% 3.0% vehicles. However, they incur higher native fuel vehicles Road tax 0.88 1.44 0.63 Waived majorly

The number of EV charging

2.0% overall maintenance costs due to the (Rs. in lakh)

20.0% 1.0% signifi cant upkeep required for engines, stations is growing, but it’s nowhere

0.0% 0.0% including frequent oil changes and part near enough to meet the potential Lifetime main- 0.60 0.70 0.70 0.30

demand (see Figure 2). Range anxiety

tenance cost

maintenance.

2020 2021 2022 2023

remains a major concern for EV (Rs. in lakh)

Diesel Petrol CNG EV (BOV) Over the years, CNG has gained buyers. Similarly, while India has Net cost of owner- 28.38 27.43 20.46 16.70

LPG Petrol/CNG Petrol/Hybrid popularity, particularly in urban areas, a decent network of CNG stations ship (Rs. in lakh)

Fig. 1: Changing trend of vehicle sales, based on fuel type for its relatively lower cost compared compared to LPG or other flex Source: CareEdge Ratings.

Source: Vahan and CareEdge Ratings. to petrol and diesel. CNG is commonly fuels, it is still far less extensive Assumptions based on same vehicle type, average cost and range.

166 Chemical Weekly April 23, 2024 Chemical Weekly April 23, 2024 167

Contents Index to Advertisers Index to Products Advertised