Page 177 - CW E-Magazine (8-7-2025)

P. 177

Special Report

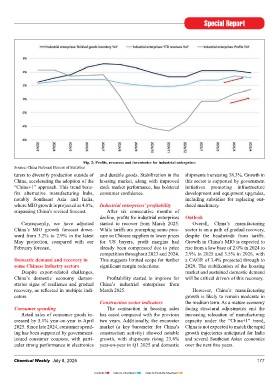

Fig. 2: Profi ts, revenues and inventories for industrial enterprises

Source: China National Bureau of Statistics

turers to diversify production outside of and durable goods. Stabilization in the shipments increasing 38.3%. Growth in

China, accelerating the adoption of the housing market, along with improved this sector is supported by government

“China+1” approach. This trend bene- stock market performance, has bolstered initiatives promoting infrastructure

fi ts alternative manufacturing hubs, consumer confi dence. development and equipment upgrades,

notably Southeast Asia and India, including subsidies for replacing out-

where MIO growth is projected at 4.0%, Industrial enterprises’ profi tability dated machinery.

surpassing China’s revised forecast. After six consecutive months of

decline, profi ts for industrial enterprises Outlook

Consequently, we have adjusted started to recover from March 2025. Overall, China’s manufacturing

China’s MIO growth forecast down- While tariffs are prompting some pres- sector is on a path of gradual recovery,

ward from 3.2% to 2.9% in the latest sure on Chinese suppliers to lower prices despite the headwinds from tariffs.

May projection, compared with our for US buyers, profi t margins had Growth in China’s MIO is expected to

February forecast. already been compressed due to price rise from a low base of 2.0% in 2024 to

competition throughout 2023 and 2024. 2.9% in 2025 and 3.5% in 2026, with

Domestic demand and recovery in This suggests limited scope for further a CAGR of 3.4% projected through to

some Chinese industry sectors signifi cant margin reductions. 2029. The stabilization of the housing

Despite export-related challenges, market and sustained domestic demand

China’s domestic economy demon- Profi tability started to improve for will be critical drivers of this recovery.

strates signs of resilience and gradual China’s industrial enterprises from

recovery, as refl ected in multiple indi- March 2025. However, China’s manufacturing

cators. growth is likely to remain moderate in

Construction sector indicators the medium term. As a mature economy

Consumer spending The contraction in housing sales facing structural adjustments and the

Retail sales of consumer goods in- has eased compared with the previous increasing relocation of manufacturing

creased by 5.1% year-on-year in April two years. Additionally, the excavator capacity under the “China+1” trend,

2025. Since late 2024, consumer spend- market (a key barometer for China’s China is not expected to match the rapid

ing has been supported by government- construction activity) showed notable growth trajectories anticipated for India

issued consumer coupons, with parti- growth, with shipments rising 23.8% and several Southeast Asian economies

cular strong performance in electronics year-on-year in Q1 2025 and domestic over the next fi ve years.

Chemical Weekly July 8, 2025 177

Contents Index to Advertisers Index to Products Advertised