Page 176 - CW E-Magazine (8-7-2025)

P. 176

Special Report

Tariff headwinds and domestic tailwinds: China’s

manufacturing outlook for 2025

t has been over two months since Impact of tariff s on Chinese manu- SAMANTHA MOU

the Trump administration announ- facturing Research Analyst,

Iced reciprocal tariff s, with tar- The tariff s have primarily aff ected Interact Analysis

iff s on Chinese goods at one stage China’s manufacturing exports, with E-mail: samantha.mou@interact-

exceeding 100%. These measures have several key indicators refl ecting this analysis.com

raised widespread concern that China’s pressure:

economic recovery could be signifi - scoring the considerable pressure tariff s

cantly hindered in 2025, following a Manufacturing PMI and export exerted on export volumes.

period of slower growth throughout performance

2023 and 2024. China’s manufacturing Purchas- Price and defl ationary pressures

ing Managers’ Index (PMI) fell into Consumer Price Index (CPI) and

While recent monthly indicators contraction territory in April and May, Producer Price Index (PPI) trends point

suggest a slowdown in China’s manu- registering 49.0 and 49.5 respectively, to ongoing defl ationary pressures as of

facturing sector in April and May, a after recovering above 50 in February April 2025, with both indices continu-

broader examination indicates that the and March. Export growth also slowed; ing to decline. The reduced demand

tariff s are unlikely to cause an outright April saw year-on-year growth of 8.1%, from US markets is contributing to

economic decline but may delay the a drop from 12.3% growth in March excess supply within China, which in

return to robust growth. before tariff s took full eff ect. Exports to turn weighs on prices.

the US (China’s third-largest trade part-

China’s manufacturing sector re- ner) accounted for approximately 15% Supply chain shifts: The “China+1”

covery could be slowed down by US of total exports in 2024, but declined strategy

trade tariff s, but is unlikely to stall. 21% year-on-year in April 2025, under- US tariff s are encouraging manufac-

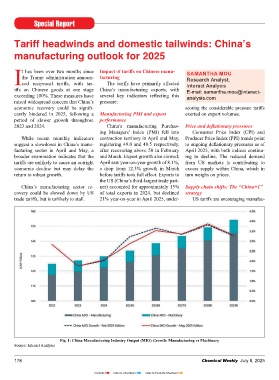

Fig. 1: China Manufacturing Industry Output (MIO) Growth: Manufacturing vs Machinery

Source: Interact Analysis

176 Chemical Weekly July 8, 2025

Contents Index to Advertisers Index to Products Advertised